Home » Posts tagged 'trading'

Tag Archives: trading

Open Orphan #ORPH – Proposal to purchase Poolbeg Pharma shares from distribution in specie shareholders

Open Orphan (ORPH) a rapidly growing specialist contract research organisation (CRO) and world leader in testing infectious and respiratory disease products using human challenge clinical trials, notes the announcement dated 11 April 2022 from Poolbeg Pharma plc (“Poolbeg”), regarding a number of new investors (“New Investors”) having expressed interest in acquiring up to £1.6m of Poolbeg which are currently locked-up and held in trust by Croft Nominees Limited as a result of the distribution in specie from Open Orphan on 18 June 2021.

Open Orphan (ORPH) a rapidly growing specialist contract research organisation (CRO) and world leader in testing infectious and respiratory disease products using human challenge clinical trials, notes the announcement dated 11 April 2022 from Poolbeg Pharma plc (“Poolbeg”), regarding a number of new investors (“New Investors”) having expressed interest in acquiring up to £1.6m of Poolbeg which are currently locked-up and held in trust by Croft Nominees Limited as a result of the distribution in specie from Open Orphan on 18 June 2021.

As part of these proposals, the New Investors have committed to purchase up to £1.6m of the distribution in specie shares on or around 26 April 2022 at a price of 5.9 pence per share, the closing market price on Friday 8 April 2022. The New Investors have shown great interest in the Poolbeg story, its significant progress since IPO in July 2021, and its capabilities in developing novel products utilising its unique cost-effective model in the fast-growing infectious disease market which is expected to be worth in excess of $250bn by 2025. This is a clear vote of confidence in Poolbeg’s prospects as it enters an extremely exciting phase of its development with its first LPS human challenge clinical trial due to commence in June 2022 with multiple value inflection points expected in 2022 and beyond.

This process will allow the locked-up distribution in specie shareholders in Poolbeg the opportunity to sell part or all of their shareholding, should they wish to do so, prior to receiving the shares once the lock-up period ends on 20 April 2022. The distribution in specie shareholders will receive a letter setting out the New Investors’ proposal and a Form of Election informing them how to participate should they wish to sell some or all of their shares prior to the lock-up ending on 20 April 2022. These proposals are open to all distribution in specie shareholders but participation is at each distribution in specie shareholder’s discretion. For those shareholders who do not participate, the title to their distribution in specie shares will be transferred to them on or around 26 April 2022. If more than £1.6m is offered by way of valid Forms of Election, then the distribution in specie shareholders will be scaled back on a pro-rata basis.

The distribution in specie shares are exempt from income tax for UK resident shareholders due to the advance clearance obtained by the Company from HMRC for a statutory demerger. As such, there should be no UK income tax liabilities for UK resident shareholders on receipt of these shares. The only time that UK resident shareholder will be subject to tax on these shares will be in the event that the shareholder sells them, and in that event there will be a capital gains tax payment due on any chargeable gain. The base cost for capital gains calculation purposes will be 1% of the original cost base of the Open Orphan shares which will be close to nil (0), therefore nearly the full consideration will be subject to capital gains tax. The above comments are intended only as a general guide, shareholders are encouraged and recommended to seek their own financial and tax advice.

Open Orphan plc and Poolbeg Pharma plc ordinary shares are ISA qualifying investments. Open Orphan understands that any distribution in specie shares held in an ISA should be treated in a similar way to any other income generated from ISA qualifying investments.

A copy of the letter to distribution in specie shareholders can be found on Poolbeg’s website here and an FAQ is available here.

Cathal Friel, Executive Chairman of Open Orphan, said: “We were delighted to see that despite the presently turbulent market that Poolbeg has successfully managed to bring in fresh investors to purchase up to £1.6m at 5.9p, the market price on Friday 8 April 2022. The new investors have shown great interest in the Poolbeg story and its significant progress since IPO, its capabilities in developing novel infectious disease products utilising its unique cost-effective model. Poolbeg is well capitalised, with c. £20.9m at year end 2021, so importantly it is not raising any new funds as part of this process and, as such, there will be no dilution of existing shareholders.

“This arrangement has followed significant efforts to help widen the Poolbeg investor base and increase future liquidity, in order to ensure that the dividend in specie remains as beneficial as possible to shareholders of both Open Orphan and Poolbeg in the long-term.

“Due to the nature of the lock-up period, which was designed to allow for an orderly market following Poolbeg’s admission to AIM, prospective investors looking to build more substantial stakes were unable to do so. These proposals ensure that any potential shares sold will be going to quality, long-term holders, whilst giving distribution in specie shareholders the option to sell shares prior to the end of the lock-up period, if they choose to do so. In addition, there will be substantially greater liquidity in our shares once the distribution in specie shares have been distributed after 26 April 2022 and we believe this will certainly help us to attract in even more new shareholders.”

Footnote

The distribution in specie shares were issued to all Open Orphan shareholders on the share register at close of business on 17 June 2021, following this, Poolbeg successfully listed on the London Stock Exchange AIM market on 19 July 2021. While the underlying shareholders retain the beneficial ownership of the shares, the distribution in specie shares are currently held in trust by Croft during a lock-up period of nine calendar months from Poolbeg’s admission to AIM, to contribute to the creation of an orderly market. This lock-up period will end on 20 April 2022 and on or around 26 April 2022, shareholders will be sent a share certificate for the distribution in specie shares. Shareholders will then have the option to dematerialise and hold the shares via CREST. If any Open Orphan shares that gave rise to the entitlement to the distribution in specie shares are held in a nominee account, the share certificate will be sent to the shareholders’ broker.

The New Investors’ proposals are not open for participation by persons interested in shares who are residents or citizens of or who have an address in, or who otherwise appear to the Company or SLC Registrars to be connected to, the United States (or any of its territories or possessions), Canada, Australia, Japan, Belarus or Russia.

For further information please contact:

|

Open Orphan plc |

+353 (0) 1 644 0007 |

||

|

Cathal Friel, Executive Chairman Yamin Khan, Chief Executive Officer |

|||

|

Arden Partners plc (Nominated Adviser and Joint Broker) |

+44 (0) 20 7614 5900 |

||

|

John Llewellyn-Lloyd / Louisa Waddell |

|||

|

finnCap plc (Joint Broker) |

+44 (0) 20 7220 0500 |

||

|

Geoff Nash / James Thompson / Richard Chambers |

|||

|

Davy (Euronext Growth Adviser and Joint Broker) |

+353 (0) 1 679 6363 |

||

|

Anthony Farrell |

|||

|

Walbrook PR (Financial PR & IR) Paul McManus / Sam Allen / Louis Ashe-Jepson |

+44 (0)20 7933 8780 or openorphan@walbrookpr.com +44 (0)7980 541 893 / +44 (0) 7502 558 258 / +44 (0) 7747 515393 |

||

Notes to Editors

Open Orphan plc

Open Orphan plc (London and Euronext: ORPH) is a rapidly growing contract research company that is a world leader in testing infectious and respiratory disease products using human challenge clinical trials. The Company provides services to Big Pharma, biotech, and government/public health organisations.

The Company has a leading portfolio of human challenge study models for infectious and respiratory diseases, including the recently established COVID-19 model, and is developing a number of new models, such as Malaria, to address the dramatic growth of the global infectious disease market. The Paris and Breda offices have over 25 years of experience providing drug development services such as biometry, data management, statistics CMC, PK and medical writing to third party clients as well as supporting the London-based challenge studies.

Open Orphan runs challenge studies in London from its Whitechapel quarantine clinic, its state-of-the-art QMB clinic with its highly specialised on-site virology and immunology laboratory, and its newly opened clinic in Plumbers Row. To recruit volunteers / patients for its studies, the Company leverages its unique clinical trial recruitment capacity via its FluCamp volunteer screening facilities in London and Manchester. The newly opened facilities have expanded the scope of the business to enable the offering of Phase I and Phase II vaccine field trials, PK studies, bridging studies, and patient trials as part of large international multi-centre studies.

Building upon its many years of challenge studies and virology research, the Company is developing an in-depth database of infectious disease progression data. Based on the Company’s Disease in Motion® platform, this unique dataset includes clinical, immunological, virological, and digital (wearable) biomarkers.

About Poolbeg Pharma

Poolbeg Pharma is a clinical stage infectious disease pharmaceutical company, with a capital light clinical model which aims to develop multiple products faster and more cost effectively than the conventional biotech model. The Company, headquartered in London, is led by a team with a track record of creation and delivery of shareholder value and aspires to become a “one-stop shop” for Big Pharma seeking mid-stage products to license or acquire.

The Company is targeting the growing infectious disease market. In the wake of the COVID-19 pandemic, infectious disease has become one of the fastest growing pharma markets and is expected to exceed $250bn by 2025.

With its initial assets from Open Orphan plc , an industry leading infectious disease and human challenge trials business, Poolbeg has access to knowledge, experience, and clinical data from over 20 years of human challenge trials. The Company is using these insights to acquire new assets as well as reposition clinical stage products, reducing spend and risk. Amongst its portfolio of exciting assets, Poolbeg has a small molecule immunomodulator for severe influenza (POLB 001); a first-in-class, intranasally administered RNA-based immunotherapy for respiratory virus infections (POLB 002); and a vaccine for Melioidosis (POLB 003). The Company is also developing an oral vaccine delivery platform and is progressing two artificial intelligence (AI) drug discovery programmes to accelerate the power of its human challenge model data and biobank.

For more information, please go to www.poolbegpharma.com or follow us @PoolbegPharma

#ORPH Open Orphan – Open Orphan plc distribution in specie of Poolbeg Pharma plc shares – FAQ

When will I receive my share certificate?

The Poolbeg Pharma shares received are subject to a lock-up period that ends on 19 April 2022. Within 14 days of that date, shareholders will be sent a certificate for their distribution in specie shares. Shareholders will then have the option to dematerialise the shares and hold via CREST.

If your Open Orphan plc shares that gave rise to the entitlement to the distribution in specie shares are held in a nominee account, the share certificate will be sent to your broker who can add these to your account.

There has been some confusion among some investors enquiring whether these locked-up distribution in specie shares can currently be traded. Please note that these shares cannot yet be traded because they have not yet been transferred from the nominee (Croft Nominees Ltd) where they are being held in trust during the lock-up period. After the end of the lock-up period when the shares have been transferred, they will then be fully tradeable like any other public company share.

Why aren’t the shares in my online trading account?

As explained above, during the lock-up period the legal title to the shares are held by Croft Nominees Limited. The underlying shareholders retain the beneficial ownership of the shares. Shareholders with online trading accounts should see their future entitlement on their online platform but they cannot be traded and will show no value until after the end of the lock-up period when the shares will be transferred.

Therefore, as per above, you cannot trade shares that you are not yet in receipt of, but after the end of the lock-up period when the shares have been transferred, they will be fully tradeable like any other public company share.

Who are Croft Nominees Limited?

Croft Nominees Limited, is an entity controlled by the lawyers to Open Orphan and Poolbeg Pharma, DAC Beachcroft. DAC Beachcroft were appointed by Open Orphan and Poolbeg Pharma to act as custodian for the nine-month post IPO lock-up of Poolbeg Pharma shares. This appointment is to help facilitate the practical enforcement of the lock-up restrictions.

Within 14 days post the end of the lock-up, Croft Nominees will no longer hold any of these shares, as their sole function was to act as a holding nominee which is standard practice in these types of transactions.

Why is there a lock-up period?

The lock-up period is intended to contribute to the creation of an orderly market for a period after Poolbeg Pharma’s admission to trading on AIM. Poolbeg Pharma’s admission to AIM took place on 19 July 2021. Such lock-up periods can vary from 3, 6, 9, or 12 months in length and the Company took the decision to lock-up shareholders for a 9-month period.

Will there be tax on the distribution in specie shares?

The following comments are intended only as a general guide, shareholders are encouraged and recommended to seek their own financial tax advice.

A. UK resident shareholders: The distribution in specie shares issued to shareholders as part of the demerger from Open Orphan are treated as a distribution for UK tax purposes, which could be taxable as dividend income. However, as advance clearance for a statutory demerger was obtained from HMRC, the distribution is exempt for UK income tax purposes, and hence there should be no UK income tax liabilities for UK resident shareholders upon receipt of these distribution in specie shares.

Disposal of the distribution in specie shares by UK resident shareholders will be subject to capital gains tax if a chargeable gain is made. The capital gains tax base cost is close to nil (0), therefore nearly the full consideration will be subject to capital gains tax.

There has been some confusion around the base cost and some shareholders thought that the base cost for these shares might be 6p, however, we can clarify that the base cost for capital gains purposes is close to nil because no consideration was paid for the receipt of these shares.

B. UK resident shareholders with shares held in an ISA:

Open Orphan plc and Poolbeg Pharma plc ordinary shares are ISA qualifying investments.

The Company can confirm based on advice received that if a shareholder held Open Orphan plc shares in an ISA account on the ex-dividend date (17 June 2021), the resulting Poolbeg Pharma distribution in specie shares should be directed to and held in your ISA account after 19 April 2022 when they are released from lock-up. This dividend income received into your ISA is treated the same way as any other exempt income that was generated from your ISA qualifying investment.

As with all ISA held shares, should you sell your dividend in specie Poolbeg shares, there will be no tax payable if the proceeds remain within your ISA account.

In addition, if these distribution in specie Poolbeg shares remain within the ISA, they do not form part of the £20k annual ISA allowance as they result from a distribution from an existing ISA shareholding.

We fully understand that there had been some confusion among some of our investors and also potentially among some of the ISA online account managers, but we can confirm that shareholders should have no issue retaining Poolbeg Pharma dividend in specie shares within a qualifying ISA account.

C. Ireland resident shareholders: Advice has been obtained from professional advisors in Ireland who have confirmed that there should be no Irish income tax liabilities as a result of the issue of the distribution in specie shares as part of the demerger. The receipt of dividends could be subject to Irish income tax, and independent advice should be sought.

Disposal of the distribution in specie shares by Irish resident shareholders will be subject to capital gains tax if a chargeable gain is made. The capital gains tax base cost is close to nil, therefore nearly the full consideration will be subject to capital gains tax. There has been some confusion around the base cost and some shareholders thought that the base cost for these shares might be 6p, however, we can clarify that the base cost for capital gains purposes is close to nil because no consideration was paid for the receipt of these shares.

D. Non-UK and Non-Irish resident shareholders: May be subject to tax on dividend income under any law to which they are subject to outside the UK. In addition, they may be subject to tax on a future disposal of shares under any law to which they are subject to outside the UK. Such shareholders should consult their own tax advisers concerning their tax liabilities.

What is the base cost for tax purposes if distribution in speice Poolbeg Pharma shares which are not held in an ISA?

If a UK resident shareholder sells their Poolbeg Pharma distribution in specie shares there will be capital gains tax payable, however as stated above, there will be no income tax due on receipt on these shares. The base cost for capital gains calculation purposes will close to nil (0), therefore nearly the full consideration will be subject to capital gains tax.

There has been some confusion around the base cost and some shareholders thought that the base cost for these shares might be 6p, however, we can clarify that the base cost for capital gains purposes is close to nil because no consideration was paid for the receipt of these shares.

Please note, no capital gains or other tax will be due until the taxpayer sells the Poolbeg Pharma shares in the first instance.

How does general meeting voting work for distribution in speice shareholders?

Poolbeg Pharma and Croft Nominees Limited have organised for distribution in specie shareholders to vote in its upcoming AGM via Poolbeg Pharma’s share registrars, SLC Registrars Limited. Shareholders have been sent a Form of Direction to vote which should be returned to the registrars. This document and all other documents relating to the AGM can be found here: https://www.poolbegpharma.com/investors/documents/

How many shares are received for holdings in Open Orphan?

Open Orphan shareholders who were on the register at close of business on 17 June 2021 were allocated shares using a ratio of 1 Poolbeg Pharma share for every 2.98 ordinary shares held in Open Orphan.

What is the ongoing relationship between Open Orphan and Poolbeg Pharma?

Open Orphan and Poolbeg Pharma are non associated companies that are run independently of each other, both are listed on the AIM market of the London Stock Exchange with independent boards and management teams. There is a number of cost synergies including shared office space and shared staff costs.

For further information, please read the following demerger update announced by Open Orphan on 17 June 2021:

https://www.investegate.co.uk/open-orphan-plc–orph-/rns/demerger-update/202106170700091713C/

Is the hype finally over for Bitcoin, Altcoins and NFTs?

By Arjun Thakkar and Alan Green

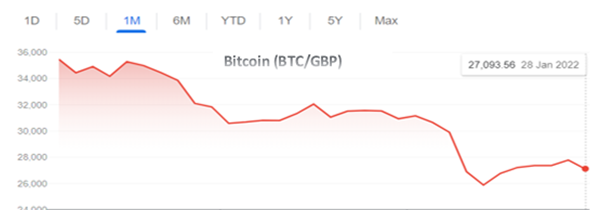

Crypto volatility is back…and then some! Some investors called it downtrend others call it a cryptocurrency reset. The recent cryptocurrency crash wiped out nearly $1 trillion of wealth; Bitcoin fell by 30% while Ethereum dropped by 45% between Dec 2021 – Jan 2022. Although data shows 70% of crypto investors joined the market in 2021, the question everyone is asking is whether crypto market dilution and the uninitiated selling out is the reason for the downtrend, or rathermore is it due to new and better Initial Coin Offerings (ICOs) offering better value? It could of course be nothing more than a normal market correction? Let’s discover!

Theoretically, there is an inverse relationship between interest rates and the prices of opportunity costs such as stock prices, commodity prices and crypto valuation. Moves by central banks such as the Federal Reserve and Bank of England over the past few weeks have had a major influence on the financial markets. We now know that Russia is considering a ban on cryptocurrency and China has announced fresh regulations that include the banning of mining, a massive clamp down on ICOs, all of which has contributed to the huge sell-off.

Despite the fact that monetary policies and interest rates will affect prices in the short-term, the manner in which blockchain or cryptocurrency will be utilized in the future will largely determine its longevity and relevance. Financial institutions such as JP Morgan have started using blockchain technology for the security, speed and privacy of end-to-end transactions. It is already widely accepted that blockchain can be used to verify documents and speed up process with the help of smart contracts in industries like real estate or insurance.

Put simply blockchain and crypto currencies are here to stay. Governments and sovereignties including El Salvador have already adopted Bitcoin as legal tender, so the gradual recognition and acceptance of blockchain and cryptocurrency as legal tender seems almost inevitable despite the recent moves by the Chinese government and the Russian central bank to enforce regulations. But even the latest developments in Russia suggest that President Vladimir Putin and the Russian Finance ministry have changed tack and backed blockchain and crypto mining, albeit with measures to tax and regulate the crypto mining industry.

Altcoins

Despite the recent price correction and downturn affecting all cryptocurrencies, our view is that this is little more than a systemic risk and ‘healthy’ market correction. It is worth considering the individual performances (pre correction) of many altcoins such as Solana and Cardano, which have blasted onto the scene giving higher returns than well-known cryptos like Bitcoin and Ethereum. This despite both Solana and Cardano being built on Ethereum and relying on the Ethereum Blockchain to function.

The rising popularity of these altcoins is due to their improved functionality and their ability to facilitate smart contracts and host decentralized applications at a lower cost than giant rivals like Ethereum. Not only do they offer lower transaction costs but altcoins like Solana are faster and can handle around 50,000 more transactions per second.

Although Solana, Cardano and Ethereum can be used to deliver smart contracts, there are still questions over Bitcoin’s use and functionality going forward? Currently the primary purpose of Bitcoin is to facilitate the transfer of funds via a secure network, although it is worth noting that companies like Coinsilium (AQSE: COIN) (OTCQB: CINGF), are engaged in partnerships to build a Bitcoin marketplace for NFTs and to enable transition of RSK blockchain standard NFTs to other blockchain standard NFTs including Ethereum.

NFTs

Another burgeoning sector in the crypto and blockchain space is of course Non-Fungible Tokens (NFTs). These were hugely popular a few months back, and some were created by celebrities including William Shatner, Leonardo Messi and Justin Bieber. It does seem at the moment that some of the initial hype has waned so the question remains; are NFTs still a relevant asset class or were they just a flash in the pan?

Our belief is that although interest has waned in the short term, this has largely come about as a result of other major global events and developments taking centre stage as already outlined. Omicron, followed by a stock market and crypto market crash in January 2022 due to Russia and China moves against crypto currency have seen many less experienced investors sell up and get out. These events may have combined to move focus away from the NFT hype in the short term, but we believe longer term the hype and demand for NFTs will return. The size of the NFT market passed $40 billion in 2021 and is expected to double by 2025.

Our belief is that although interest has waned in the short term, this has largely come about as a result of other major global events and developments taking centre stage as already outlined. Omicron, followed by a stock market and crypto market crash in January 2022 due to Russia and China moves against crypto currency have seen many less experienced investors sell up and get out. These events may have combined to move focus away from the NFT hype in the short term, but we believe longer term the hype and demand for NFTs will return. The size of the NFT market passed $40 billion in 2021 and is expected to double by 2025.

And NFTs are still catching the headlines too. Celebrities Kevin Hart and Paris Hilton recently bought a Bored Ape Yacht Club NFT for over $300,000.

Apart from the traditional use of NFTs as a form of art, they also offer the potential to buy digital lands in virtual worlds like the metaverse, and the potential to license and publish music ownership. Interest and hype may ebb and flow, but NFTs are definitely here to stay.

Stick or Twist

In summary, we believe that while the sharp price movements in cryptocurrency will continue, altcoins like Solana and Cardano with their higher transaction speeds and lower gas fees offer great potential from here on. Alternative uses for Bitcoin – the king of crypto, such as a Bitcoin marketplace for NFTs adds a new dimension and functionality to the original cryptocurrency and a potential target price of $100k in a couple of years.

All in all, for investors able to cope with the sharp price movements, investing into Bitcoin, Altcoins and NFTs looks likely to deliver an increase in portfolio value over the longer term, and always the potential to deliver spectacular quick gains for short term traders. In pontoon parlance – Twist!