Home » Posts tagged 'shareholder' (Page 3)

Tag Archives: shareholder

#BRES Blencowe Resources – Investor Call

Blencowe Resources (BRES:LON), the graphite explorer developing the Orom-Cross jumbo flake graphite project in Uganda, is pleased to announce that it will host a shareholder conference call and Q&A via Zoom conferencing on Thursday 17 February 2022 at 10:00am UK time (6:00pm WST time).

The call will be hosted by Blencowe’s CEO Mike Ralston who will be updating on the recently announced successful drilling results as well as the Company’s strategy moving forward.

Interested investors are invited to register using the following link:

https://us02web.zoom.us/webinar/register/WN_NPAroCXpT6OQIWKP1Xox1Q

Those who wish to may add this event to their online diary by clicking here:

https://www.addevent.com/event/DZ11954380

Shareholders who wish to do so are invited to submit questions via email to info@blencoweresourcesplc.com

The most recent copy of the Company’s corporate presentation can be found at the following link:

https://blencoweresourcesplc.com/presentation/

Please note that until the Q&A session has begun that all participants will initially be muted without audio with the exception of Company management. A recording of the call will also be made available on the Company’s website following the call.

**ENDS**

Contacts

|

Blencowe Resources Plc

Sam Quinn (London Director)

|

info@blencoweresourcesplc.com +44 (0)1624 681 250

|

|

Investor Enquiries Sasha Sethi

|

Tel: +44 (0) 7891 677 441 sasha@flowcomms.com

|

|

Brandon Hill Capital Limited Jonathan Evans

|

Tel: +44 (0)20 3463 5000 jonathan.evans@brandonhillcapital.com |

|

First Equity Limited Jason Robertson |

Tel: +44 (0)20 7330 1883 jasonrobertson@firstequitylimited.com |

Ananda Developments #ANA – Shareholder Update

Ananda’s ambition is to be a leading UK grower and provider of high quality, consistent, carbon zero medical cannabis for the UK and international markets.

The Directors of Ananda provide the following update to shareholders.

Commencement of medical cannabis cultivation

The first cannabis seeds were planted yesterday at Ananda’s 50% owned company, DJT Plants Limited’s (“DJT Plants”) medical cannabis research facility. Dr Hadar Less, DJT Plants’ Lead Geneticist, and team have now started the first stage of the research programme.

The research programme is designed to create a library of stable cannabis genetics in order to ‘match’ cannabis plant profiles with clinical indications. The research plan involves self-crossing a selection of cannabis strains for six generations and then conducting field trials in the multi-chapelle structures to determine which stable strains produce chemovars with desired metabolic profiles and which thrive in DJT Plants’ growing conditions.

Ananda’s ultimate ambition is to be a commercial grower and provider of high quality, consistent cannabis medicines. There are currently around 12,000 medical cannabis patients in the UK (up from around 3,000 when DJT’s licence was granted), currently being prescribed a combination of medical cannabis flower and oils. All of these unlicenced cannabis medicines are currently imported. The directors of Ananda believe that there is an unmet need for high quality, consistent medical cannabis grown in the UK, which meets the Medicines and Healthcare products Regulatory Agency (MHRA) Good Manufacturing Practice (GMP) standards.

Acquisition of the 50% of DJT Group Limited not already owned by Ananda (“Acquisition”)

The Acquisition process is largely complete, and the Company expects to post the relevant circular to shareholders shortly.

Since announcing the Acquisition, the parties (Ananda and Anglia Salads Limited) have been working as one team to execute the construction and commissioning of the research facility. Weekly Executive Committee calls take place and more recently Operations calls have also been initiated. As a result of the experience of the past eight or so months it has been decided by DJT Plants and Ananda that Stuart Piccaver and Simon Goddard will take the positions of Chairman of DJT Plants and CFO of DJT Plants, respectively. They will both also join the board of Ananda as executive directors. Initially it was contemplated that Stuart would be appointed as Ananda’s Joint CEO and that Simon would be Ananda’s CFO. However, it is the view of all parties that this revised structure will allow Stuart to be more focused on DJT Plants, as Ananda’s most important operating entity, whilst Melissa Sturgess will maintain responsibility for public company matters. Simon’s expertise in financial operations management is crucial and his energy is also agreed to be best focused at the DJT Plants level.

Melissa Sturgess, Ananda’s CEO, commented: “Since receiving our licence to grow medical cannabis for research in May 2021, our site team has reviewed and revised the plans which were submitted to the Home Office in October 2019, completed detailed drawings, finalised costings, commenced and completed construction and commissioned our medical cannabis research facility and multi-chapelle growing structures. Credit goes to Stuart Piccaver and his team, in particular Phil Hubbert, who have delivered this result. They have used their 25 plus years’ experience in constructing high-care horticultural facilities to ensure execution of this stage of the project. We do not underestimate the importance of team loyalty, local knowledge and the strength of existing supplier relationships which has seen timely construction during well-known COVID supply chain challenges.

We have all worked very well together as a cohesive and cooperative unit, over the past 8 months in particular. As we continue towards our clear objective of growing and providing high quality, consistent UK grown cannabis medicines to patients in need, we are mindful that we are transitioning from an ‘ideas’ company to an ‘operating’ company and that a results oriented, best in class multi-disciplinary team will be one of the keys to our success.”

Is the hype finally over for Bitcoin, Altcoins and NFTs?

By Arjun Thakkar and Alan Green

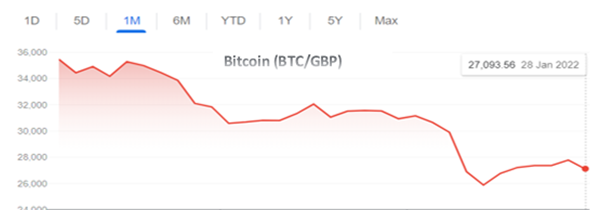

Crypto volatility is back…and then some! Some investors called it downtrend others call it a cryptocurrency reset. The recent cryptocurrency crash wiped out nearly $1 trillion of wealth; Bitcoin fell by 30% while Ethereum dropped by 45% between Dec 2021 – Jan 2022. Although data shows 70% of crypto investors joined the market in 2021, the question everyone is asking is whether crypto market dilution and the uninitiated selling out is the reason for the downtrend, or rathermore is it due to new and better Initial Coin Offerings (ICOs) offering better value? It could of course be nothing more than a normal market correction? Let’s discover!

Theoretically, there is an inverse relationship between interest rates and the prices of opportunity costs such as stock prices, commodity prices and crypto valuation. Moves by central banks such as the Federal Reserve and Bank of England over the past few weeks have had a major influence on the financial markets. We now know that Russia is considering a ban on cryptocurrency and China has announced fresh regulations that include the banning of mining, a massive clamp down on ICOs, all of which has contributed to the huge sell-off.

Despite the fact that monetary policies and interest rates will affect prices in the short-term, the manner in which blockchain or cryptocurrency will be utilized in the future will largely determine its longevity and relevance. Financial institutions such as JP Morgan have started using blockchain technology for the security, speed and privacy of end-to-end transactions. It is already widely accepted that blockchain can be used to verify documents and speed up process with the help of smart contracts in industries like real estate or insurance.

Put simply blockchain and crypto currencies are here to stay. Governments and sovereignties including El Salvador have already adopted Bitcoin as legal tender, so the gradual recognition and acceptance of blockchain and cryptocurrency as legal tender seems almost inevitable despite the recent moves by the Chinese government and the Russian central bank to enforce regulations. But even the latest developments in Russia suggest that President Vladimir Putin and the Russian Finance ministry have changed tack and backed blockchain and crypto mining, albeit with measures to tax and regulate the crypto mining industry.

Altcoins

Despite the recent price correction and downturn affecting all cryptocurrencies, our view is that this is little more than a systemic risk and ‘healthy’ market correction. It is worth considering the individual performances (pre correction) of many altcoins such as Solana and Cardano, which have blasted onto the scene giving higher returns than well-known cryptos like Bitcoin and Ethereum. This despite both Solana and Cardano being built on Ethereum and relying on the Ethereum Blockchain to function.

The rising popularity of these altcoins is due to their improved functionality and their ability to facilitate smart contracts and host decentralized applications at a lower cost than giant rivals like Ethereum. Not only do they offer lower transaction costs but altcoins like Solana are faster and can handle around 50,000 more transactions per second.

Although Solana, Cardano and Ethereum can be used to deliver smart contracts, there are still questions over Bitcoin’s use and functionality going forward? Currently the primary purpose of Bitcoin is to facilitate the transfer of funds via a secure network, although it is worth noting that companies like Coinsilium (AQSE: COIN) (OTCQB: CINGF), are engaged in partnerships to build a Bitcoin marketplace for NFTs and to enable transition of RSK blockchain standard NFTs to other blockchain standard NFTs including Ethereum.

NFTs

Another burgeoning sector in the crypto and blockchain space is of course Non-Fungible Tokens (NFTs). These were hugely popular a few months back, and some were created by celebrities including William Shatner, Leonardo Messi and Justin Bieber. It does seem at the moment that some of the initial hype has waned so the question remains; are NFTs still a relevant asset class or were they just a flash in the pan?

Our belief is that although interest has waned in the short term, this has largely come about as a result of other major global events and developments taking centre stage as already outlined. Omicron, followed by a stock market and crypto market crash in January 2022 due to Russia and China moves against crypto currency have seen many less experienced investors sell up and get out. These events may have combined to move focus away from the NFT hype in the short term, but we believe longer term the hype and demand for NFTs will return. The size of the NFT market passed $40 billion in 2021 and is expected to double by 2025.

Our belief is that although interest has waned in the short term, this has largely come about as a result of other major global events and developments taking centre stage as already outlined. Omicron, followed by a stock market and crypto market crash in January 2022 due to Russia and China moves against crypto currency have seen many less experienced investors sell up and get out. These events may have combined to move focus away from the NFT hype in the short term, but we believe longer term the hype and demand for NFTs will return. The size of the NFT market passed $40 billion in 2021 and is expected to double by 2025.

And NFTs are still catching the headlines too. Celebrities Kevin Hart and Paris Hilton recently bought a Bored Ape Yacht Club NFT for over $300,000.

Apart from the traditional use of NFTs as a form of art, they also offer the potential to buy digital lands in virtual worlds like the metaverse, and the potential to license and publish music ownership. Interest and hype may ebb and flow, but NFTs are definitely here to stay.

Stick or Twist

In summary, we believe that while the sharp price movements in cryptocurrency will continue, altcoins like Solana and Cardano with their higher transaction speeds and lower gas fees offer great potential from here on. Alternative uses for Bitcoin – the king of crypto, such as a Bitcoin marketplace for NFTs adds a new dimension and functionality to the original cryptocurrency and a potential target price of $100k in a couple of years.

All in all, for investors able to cope with the sharp price movements, investing into Bitcoin, Altcoins and NFTs looks likely to deliver an increase in portfolio value over the longer term, and always the potential to deliver spectacular quick gains for short term traders. In pontoon parlance – Twist!

#MSMN Mosman Oil and Gas – Director/PDMR Shareholding

Mosman Oil and Gas Limited (AIM: MSMN) the oil exploration, development, and production company, announces that on 3 February 2022, the Company was notified that John W Barr, Executive Chairman of the Company, transferred 25 million ordinary shares from Kensington Advisory Services P/L to Kensington Consulting P/L which acts as trustee of the Barr Superfund, at a price of AUD50,000.

Following the transaction, there is no change in John Barr’s beneficial ownership, which remains at 82,354,584 Ordinary Shares, representing 2.14% of the Company.

Enquiries:

|

Mosman Oil & Gas Limited John W Barr, Executive Chairman Andy Carroll, Technical Director |

NOMAD and Joint Broker SP Angel Corporate Finance LLP Stuart Gledhill / Richard Hail / Adam Cowl +44 (0) 20 3470 0470 |

|

Alma PR Justine James / Joe Pederzolli +44 (0) 20 3405 0205 +44 (0) 7525 324431 |

Joint Broker Monecor (London) Ltd trading as ETX Capital Thomas Smith 020 7392 1432 |

#TYM Tertiary Minerals – Results of AGM

Tertiary Minerals plc (LON: TYM), the AIM traded mineral exploration and development company, whose focus is on energy transition and precious metals, held its Annual General Meeting (“AGM”) today and is pleased to announce that all resolutions were duly passed.

The following proxy votes were received in respect of the resolutions. Votes withheld are not counted in a poll.

|

1. Ordinary Resolution: To receive the Accounts and Reports of the Directors and of the Auditors |

||||||

|

Votes For |

% of votes cast |

Against |

% of votes cast |

At holders’ discretion |

% of votes cast |

No. Withheld |

|

52,675,242 |

99.05 |

505,001 |

0.95 |

0 |

0 |

3,401,793 |

|

2. Ordinary Resolution: To elect Mr P B Cullen as a director |

||||||

|

Votes For |

% of votes cast |

Against |

% of votes cast |

At holders’ discretion |

% of votes cast |

No. Withheld |

|

49,641,060 |

89.98 |

4,528,743 |

8.21 |

1,000,000 |

1.81 |

1,412,233 |

|

3. Ordinary Resolution: To elect Dr M G Armitage as a director |

||||||

|

Votes For |

% of votes cast |

Against |

% of votes cast |

At holders’ discretion |

% of votes cast |

No. Withheld |

|

49,641,060 |

89.98 |

4,528,743 |

8.21 |

1,000,000 |

1.81 |

1,412,233 |

|

4. Ordinary Resolution: To reappoint Crowe U.K. LLP as Auditor of the Company |

||||||

|

Votes For |

% of votes cast |

Against |

% of votes cast |

At holders’ discretion |

% of votes cast |

No. Withheld |

|

51,375,242 |

92.61 |

3,098,639 |

5.59 |

1,000,000 |

1.80 |

1,108,155 |

|

5. Ordinary Resolution: To authorise the directors to allot shares |

||||||

|

Votes For |

% of votes cast |

Against |

% of votes cast |

At holders’ discretion |

% of votes cast |

No. Withheld |

|

44,455,976 |

80.15 |

10,013,827 |

18.05 |

1,000,000 |

1.80 |

1,112,233 |

|

6. Special Resolution: To approve dis-application of pre-emption rights |

||||||

|

Votes For |

% of votes cast |

Against |

% of votes cast |

At holders’ discretion |

% of votes cast |

No. Withheld |

|

44,355,976 |

79.97 |

10,113,827 |

18.23 |

1,000,000 |

1.80 |

1,112,233 |

For more information please contact:

|

Tertiary Minerals plc: |

||

|

Patrick Cullen, Managing Director |

+44 (0) 1625 838 679 |

|

|

SP Angel Corporate Finance LLP – Nominated Adviser and Broker |

||

|

Richard Morrison |

+44 (0) 203 470 0470 |

|

|

Caroline Rowe |

||

|

Peterhouse Capital Limited – Joint Broker |

||

|

Lucy Williams |

+ 44 (0) 207 469 0930 |

|

|

Duncan Vasey |

||

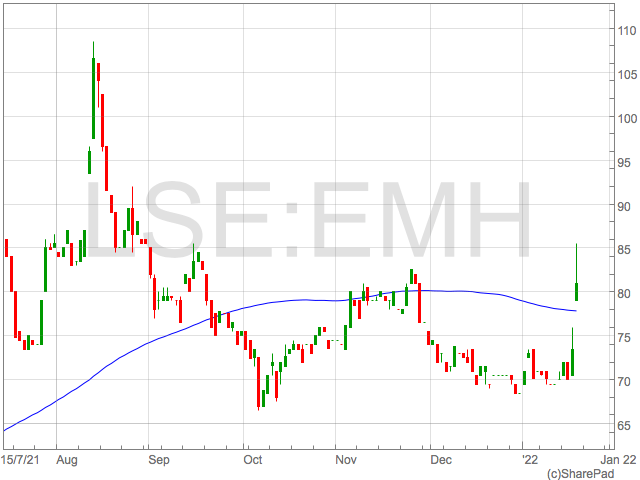

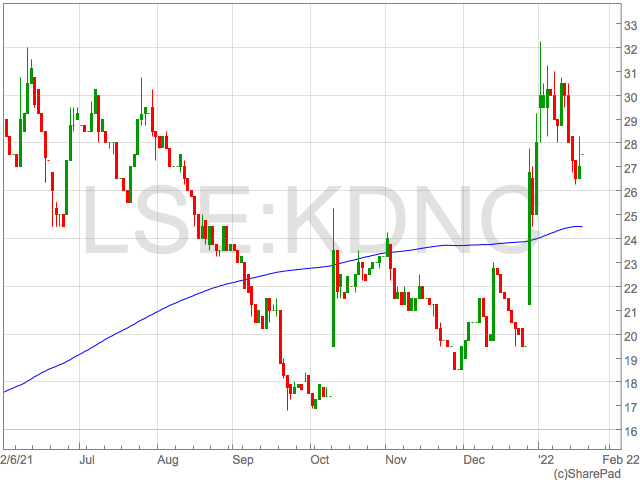

Alan Green discusses #MOON Moonpig, #KDNC Cadence Minerals & #DKL Dekel Agri-Vision on the Vox Markets podcast

Alan Green discusses #MOON Moonpig, #KDNC Cadence Minerals & #DKL Dekel Agri-Vision

View the full interview here