Home » Posts tagged 'power' (Page 2)

Tag Archives: power

#POW Power Metal Resources PLC – £900,000 Equity Financing

16th January 2023 / Leave a comment

Power Metal Resources PLC (LON:POW) the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces it has completed a placing and subscription to raise £900,000 before expenses (the “Financing”).

Power Metal Resources PLC (LON:POW) the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces it has completed a placing and subscription to raise £900,000 before expenses (the “Financing”).

HIGHLIGHTS

§ Power Metal has raised £900,000 before expenses for the advancement of priority exploration projects and for general working capital purposes with the Financing undertaken at the closing market bid price of 1.4 pence on 13 January 2023 (see below for detailed Financing terms).

§ The fundraising will be applied to a comprehensive exploration programme at the Tati gold project and will allow Power Metal to accelerate preparations for exploration at the Company’s strategic uranium portfolio in the Athabasca Basin region of Saskatchewan, Canada.

§ At Tati the Company’s exploration plans include soil geochemistry, geophysics, mechanised trenching, reverse circulation (RC) and diamond drilling. This work will examine near surface gold mineralisation across a far larger proportion of the 8km gold-in-soil anomaly which extends through the centre of the Tati licence footprint and, through planned drilling, test for gold mineralisation at depth.

§ Power Metal is seeking to undertake exploration programmes at a number of its Athabasca uranium properties during the upcoming spring and summer, following snowmelt. The work programmes will be designed to follow up on high-grade uranium rock sample results achieved by the Company during the 2022 campaigns, as well as inaugural work programmes at other properties in the portfolio which have not been worked by Power Metal to date.

§ Diamond drilling has recommenced at the Molopo Farms Complex project in Botswana after the Christmas break and specifically at drillhole DDH2-3A into target area T2-3A. In addition, at the Company’s Victoria Goldfields joint venture a diamond drill programme is underway targeting extensions of the former high-grade working Berringa gold mine.

Paul Johnson, Chief Executive Officer of Power Metal Resources plc, commented:

“Power Metal continues to drive its exploration portfolio, with drilling underway currently and with additional programmes now to be launched in the near term at the Tati gold project in Botswana and expedited exploration at the Athabasca Uranium portfolio in Saskatchewan, Canada.

With multiple exploration work streams underway Power Metal expects to release further updates to the market over the coming weeks and months as operational activities advance.

In parallel Power Metal continues to work on the various corporate initiatives targeting the generation of material value for the Company and its shareholders.

The recent strong move higher in the price of gold from under US$1,650 at the start of November 2022, to US$1,920 at the close on Friday is an important event, with gold acting as a key indicator for the strength of our sector. I believe the future is bright for the junior resource sector and the proactive junior resource explorers within it.

Power Metal has, through relentless teamwork over recent years, built and advanced our global exploration portfolio and we believe that work has positioned the Company uniquely well for the near, medium and long term.“

FINANCING FURTHER INFORMATION

§ The Company has raised £900,000 before expenses through the issue of 64,285,714 new ordinary shares of 0.1p each in the Company (the “Financing Shares”) at an issue price of 1.4p per share, the closing market bid price on 13 January 2023.

§ Each Financing Share has an attaching warrant to subscribe for one new ordinary share of 0.1p each in the Company (“Ordinary Share”) at an exercise price of 2.0p per share with a 24-month term from 30 January 2023 (“Financing Warrant”) creating 64,285,714 Financing Warrants.

§ Should the Power Metal share price exceed a volume weighted average share price of 6p for five trading days Power Metal may issue a written notice to Financing Warrant holders providing ten trading days to exercise Financing Warrants and twenty trading days to make payment of exercise monies, or the Financing Warrants may be cancelled.

§ The Financing was undertaken by the Company’s joint broker First Equity Limited. Power Metal has issued First Equity Limited with 6,428,571 warrants to subscribe for new Ordinary Shares on the same terms as the Financing Warrants.

ADMISSION AND TOTAL VOTING RIGHTS

Application will be made for the 64,285,714 Financing Shares to be admitted to trading on AIM which is expected to occur on or around 30 January 2023 (“Admission”). The Financing Shares will rank pari passu in all respects with the ordinary shares of the Company currently traded on AIM.

Following Admission, the Company’s issued share capital will comprise 1,727,574,806 ordinary shares of 0.1p each. This number will represent the total voting rights in the Company and may be used by shareholders as the denominator for the calculation by which they can determine if they are required to notify their interest in, or a change to their interest in, the Company under the Financial Conduct Authority’s Disclosure and Transparency Rules.

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“MAR”), and is disclosed in accordance with the Company’s obligations under Article 17 of MAR.

For further information please visit https://www.powermetalresources.com/ or contact:

|

Power Metal Resources plc |

|

||

|

Paul Johnson (Chief Executive Officer) |

+44 (0) 7766 465 617 |

|

|

|

|

|||

|

SP Angel Corporate Finance (Nomad and Joint Broker) |

|

||

|

Ewan Leggat/Charlie Bouverat |

+44 (0) 20 3470 0470 |

|

|

|

|

|||

|

SI Capital Limited (Joint Broker) |

|

||

|

Nick Emerson |

+44 (0) 1483 413 500 |

|

|

|

|

|||

|

First Equity Limited (Joint Broker) |

|

||

|

David Cockbill/Jason Robertson |

+44 (0) 20 7330 1883 |

|

|

#POW Power Metal Resources PLC – Victoria Goldfields Australia – Update

9th January 2023 / Leave a comment

Power Metal Resources PLC (LON:POW), the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces a corporate and exploration update from the Company’s Victoria Goldfields joint-venture (“JV”).

Power Metal Resources PLC (LON:POW), the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces a corporate and exploration update from the Company’s Victoria Goldfields joint-venture (“JV”).

Paul Johnson, Chief Executive Officer of Power Metal Resources PLC commented:

“Diamond drilling at the historic Berringa Gold Mine has efficiently recommenced after the Christmas break and the first hole is progressing well.

In other positive news we can announce the grant of 3 further licence applications as well as rock sampling results from the Dereel project which returned extensive gold mineralisation with a highlight result of 229g/t Au.

Work continues at pace in Victoria, Australia, and further updates will follow in due course.“

HIGHLIGHTS:

Diamond Drilling – Berringa Gold Mine

On 13th December 2022, Power Metal announced the commencement of a 5 hole, approximately 1,000m, diamond drilling programme at the historic Berringa Gold Mine (“Berringa”). Drilling of the first hole (BE23D001), into the Birthday South target (see announcement 13.12.22 for further information), paused on 23rd December 2022, for the holiday season at a downhole depth of 125.7m.

Drilling successfully recommenced on 3rd January 2023 with BE23D001 at end-of-day 5th January 2023, at a downhole depth of 167m at which point the HQ (96mm) drill bit was replaced by an NQ (75.7mm) bit. Drilling continues with an expected final target depth of approximately 420m.

Grant of Exploration Licences

A further three exploration licences (“ELs”) have now been granted including:

– EL 7756: a 22km2 inlier of Crown land within EL 7271, the prominent EL south of Ballarat gold mine within the Ajax project containing the old Monmouth and Happy Thought mines but where forest cover has limited modern exploration.

– EL 7799: a 3km2 inlier of Crown land originally excluded from licence EL 7327 within the Dereel Project. Investigations have identified the Golden Reef (Dereel) mine as an active high grade mine at the turn of the last century and Crown land will improve access for any future drill programme. The JV has gathered a number of rock chip samples in the area.

– EL 7826: a 4km2 tenement enhancing the land position surrounding Ballarat mine itself and covering potential for southern extension of the main Ballarat lode system known as Ballarat south within the Ajax project.

With the above now granted, seventeen EL grants have now been received from the nineteen original applications. Table 1 below provides a full breakdown.

Rock Sampling Results

A rock chip sampling programme was successfully completed within the Dereel project (EL 7799 & EL7327). The sampling campaign included the collection of 24 rock samples. Gold mineralisation was successfully identified with 16 of the 24 samples returning gold assays >0.1g/t, including a highlight result of 229g/t Au.

Table 2 below provides a breakdown of all rock sampling results.

JOINT VENTURE STRUCTURE

The joint venture (“JV”) is held through New Ballarat Gold Corporation PLC (“NBGC”), which is focused on the prolific Victoria Goldfields of Australia. The JV is held between Power Metal (49.9%) and its partner, London-listed Red Rock Resources PLC (50.1%) (together the “JV Partners”).

NBGC has a wholly owned Australian operating subsidiary Red Rock Australasia Pty Ltd (“RRAL”) which holds a strong land position comprising 17 granted exploration licences and one purchased licence for a total area of 1,867km2 within the gold fields of Victoria, Australia, principally surrounding the mining centre of Ballarat, Australia.

In addition, 2 licences covering 467km2 await grant. The JV has carefully assembled its portfolio of properties comprising a broad range from robust exploration targets to near term resource potential, which remain largely under-explored by modern explorers.

The JV Partners have the intention of listing the JV company on a recognised stock exchange and will make further announcements as appropriate.

TABLE 1: LICENCE TABLES

The seventeen granted and one purchased licence (EL005535) cover high priority areas, covering 1,867km2 as outlined below.

|

Licence Number |

Project Name |

Area (km2) |

|

EL007271

|

Buninyong (renamed) |

133 |

|

EL007281

|

Blue Chip |

74 |

|

EL007282

|

Blue Sky |

489 |

|

EL007285

|

Blue Ribbon |

8 |

|

EL007327 |

Dereel |

60 |

|

EL007385 |

Sardinia |

4 |

|

EL007329 |

Kilmore |

484 |

|

EL007301 |

Pitfield/Mt. Bute |

85 |

|

EL007328 |

Blue Yonder |

164 |

|

State land within EL007271

EL007505 |

–

|

[9] |

|

State land within EL007271

EL007506 |

– |

[9] |

|

State land within EL007271

EL007507 |

–

|

[8] |

|

EL007330 |

Daylesford (renamed)

|

202 |

EL 007294 |

Talbot(renamed)

|

129 |

EL 5535 |

Berringa |

9 (228 net ha) |

EL007756 |

Monmouth |

22 |

|

State land within EL007327

EL007799 |

Dereel (2) |

[3] |

EL007826 |

Ballarat East |

4 |

|

Total

|

1,867 |

Licence Applications:

RRAL has applications in process for two other new gold exploration licence areas, covering 467 km2 in the Victoria Goldfields of Australia including:

|

Licence Application Number |

Project Name |

Area (km2) |

|

EL007540* (3 competing applications)

|

Outer Ballarat |

142 |

|

EL007460 |

Kilmore West

|

325 |

TOTAL |

467 |

*Balmaine Gold Pty Ltd, Mercator Gold Australia Pty Ltd, and Loddon Gold Pty Ltd have put in competing applications the same day as RRAL for the ground covered by EL007540. The application considered to have greatest merit will eventually be given priority.

The following applications have also been made in Western Australia.

|

EL45/5859

|

Paterson |

227 |

|

EL45/5885 |

Pilbara/Paterson |

70 |

Table 2: ROCK CHIP SAMPLING RESULTS

Each sample below represents a 1kg sample which was pulverised and analysed with a aqua regia digest (AAS finish).

|

Sample ID |

Tenement |

Easting |

Northing |

Gold (g/t) |

|

41514 |

EL007799 |

743094.1 |

5809362 |

229 |

|

41562 |

EL007327 |

743239.5 |

5809050 |

1.67 |

|

41513 |

EL007799 |

743102.2 |

5809331 |

0.79 |

|

41515 |

EL007799 |

743095.4 |

5809397 |

0.39 |

|

41560 |

EL007327 |

743233.9 |

5809046 |

0.33 |

|

41564 |

EL007327 |

743248.8 |

5809037 |

0.3 |

|

41561 |

EL007327 |

743232.1 |

5809046 |

0.28 |

|

41563 |

EL007327 |

743252.6 |

5809041 |

0.15 |

|

41565 |

EL007327 |

743243.8 |

5809041 |

0.15 |

|

41511 |

EL007799 |

743110.2 |

5809315 |

0.08 |

|

41516 |

EL007799 |

743082.2 |

5809399 |

0.04 |

|

41512 |

EL007799 |

743108.7 |

5809318 |

0.02 |

|

41566 |

EL007327 |

743270.9 |

5809071 |

0.01 |

|

41510 |

EL007799 |

743119.2 |

5809285 |

0.01 |

|

52525 |

EL007327 |

743264.7 |

5809564 |

<0.04 |

|

58299 |

EL007327 |

743259 |

5809518 |

0.97 |

|

58300 |

EL007327 |

743262.8 |

5809508 |

0.21 |

|

58523 |

EL007327 |

743264.7 |

5809583 |

0.07 |

|

58524 |

EL007327 |

743267.8 |

5809572 |

0.1 |

|

58526 |

EL007327 |

743260.3 |

5809550 |

0.2 |

|

58295B |

EL007327 |

743267.1 |

5809491 |

0.13 |

|

58296B |

EL007327 |

743267.5 |

5809496 |

0.31 |

|

58297B |

EL007327 |

743268.8 |

5809521 |

0.27 |

|

58298B |

EL007327 |

743266.5 |

5809530 |

<0.04 |

QUALIFIED PERSON STATEMENT

The technical information in this report is compiled by David Holden, BSc, MBA, MEM, who is a member of the Australian Institute of Geoscientists and the Executive Officer and Exploration Manager of RRAL. He is a member of a recognised professional organisation and has sufficient relevant experience to qualify as a qualified person as defined in the Guidance Note for Mining, Oil and Gas Companies, published by AIM.

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“MAR”), and is disclosed in accordance with the Company’s obligations under Article 17 of MAR.

For further information please visit https://www.powermetalresources.com/ or contact:

|

Power Metal Resources plc |

|

|

Paul Johnson (Chief Executive Officer) |

+44 (0) 7766 465 617 |

|

SP Angel Corporate Finance (Nomad and Joint Broker) |

|

|

Ewan Leggat/Charlie Bouverat |

+44 (0) 20 3470 0470 |

|

SI Capital Limited (Joint Broker) |

|

|

Nick Emerson |

+44 (0) 1483 413 500 |

|

First Equity Limited (Joint Broker) |

|

|

David Cockbill/Jason Robertson |

+44 (0) 20 7330 1883 |

#POW Power Metal Resources – Tati Project Botswana Final Drill Assay Results

7th November 2022 / Leave a comment

Power Metal Resources PLC (LON:POW) the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces final results from the Company’s recently completed drilling programme on the 100% owned and operated Tati Project (“Tati” or the “Project”) located within the Tati Greenstone Belt near Francistown, Botswana.

Power Metal Resources PLC (LON:POW) the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces final results from the Company’s recently completed drilling programme on the 100% owned and operated Tati Project (“Tati” or the “Project”) located within the Tati Greenstone Belt near Francistown, Botswana.

Assay results from the first three holes which included the bonanza intercept 1m of 47.1g/t gold (“Au”) from 6m downhole depth in reverse circulation (“RC”) drillhole CHRC0003, were previously announced to the market on 3 November 2022 and can be found at the link below:

Paul Johnson, Chief Executive Officer of Power Metal Resources plc commented:

“Tati is becoming a significant Project for Power Metal – with only 175m strike distance of an 8km long gold-in-soil anomaly drill tested and extensive high-grade gold confirmed from the RC drilling.

Naturally the 47.1g/t Au and 40.6g/t Au grades peak excitement, which they should, however more important is the continuity of gold mineralisation over the 175m strike drill tested thus far, which bodes well for the significant amount of the anomaly yet to be tested. That drill testing is now a priority for Power Metal.

Complementing the extremely exciting gold exploration results we have to note the practical advantages of the Tati Project.

The gold mineralisation identified to date is near surface, significantly de-risking any mining proposition. And the Project is centred on the former working gold mine, Cherished Hope, with gold fines dumps available for processing at a local processing site, potentially generating revenue for further exploration and development of the Project.

The processing site for the fines dumps is located within 20 minutes by road from the Project, and clearly also presents an avenue for processing of gold from the newly discovered mineralised areas, subject to undertaking commercial agreements and local regulatory approvals.

All told the Tati Project is making major progress and the Company intends to accelerate its activity to undertake RC drilling to more fully test the very large Au-in-soil anomaly, prove up more extensive gold mineralisation and in parallel develop avenues for future gold production from the Project.”

Highlights:

– A total of nine RC holes totalling 490m were completed at Tati as part of the August 2022 exploration programme – representing the first ever known drilling programme carried out on prospecting licence (“PL”) 049/2022. Complete assay results have now been received for the remaining 6 holes and are presented herein.

– In addition to multiple high-grade gold intersections reported from the first three RC drillholes, significant near-surface dolerite and quartz reef hosted gold mineralisation was successfully intersected in 5 of the 6 remaining holes. Key down-hole intersections (>1g/t Au) include:

§ Hole CHRC0004

Ø 1m @ 1.36 g/t Au from surface

Ø 2m @ 1.81 g/t Au from 2m

Ø 1m @ 1.56 g/t Au from 5m

Ø 1m @ 2.53 g/t Au from 36m

§ Hole CHRC0005

Ø 1m @ 1.13 g/t Au from 22m

Ø 2m @ 1.78 g/t Au from 52m

§ Hole CHRC0006

Ø 2m @ 23.17 g/t Au from 25m, including

§ 1m @ 40.63 g/t Au from 26m

§ Hole CHRC0007

Ø 1m @ 4.80 g/t Au from 1m

Ø 2m @ 6.59 g/t from 5m, including

§ 1m @ 11.27g/t Au

Ø 1m @ 1.55 g/t from 13m

Ø 1m @ 11.16g/t from 54m

§ Hole CHRC0009

Ø 2m @ 2.11 g/t Au from 49m

– Drilling intersections have confirmed gold mineralisation over a strike length of 175m, with mineralisation remaining open towards the northwest, southeast and downdip.

– Significantly, the Q3 2022 drilling area is located along a major northwest-southeast oriented regional shear that is thought to be the control of gold mineralisation observed within the area.

– Along this major regional shear is a coincident Au-in-soil anomaly that extends for a strike distance of approximately 8km, and which is located entirely within the 100%-owned Tati Project. The majority of this geochemical anomaly remains underexplored, with additional mineralisation identified by Power Metal circa 6.5km to the northwest including Q1 2022 RC drillhole TGRC00017 which returned 3m of 5.17g/t Au from 9m 1, as well as the undrilled GoldSource Zone where rock sampling of a northwest-southeast oriented quartz reef returned up to 26.5g/t Au 2.

FURTHER INFORMATION

Figure 1 – Tati Project Overview Plan Map:

Figure 2 – Tati Project Q3 Drilling Area Zoomed Plan Map:

The maps presented above will also be uploaded to the Tati Project page on the Company’s website found at the link below:

One metre RC chip samples were riffle split and sent for analysis by Intertek Genalysis in Perth Western Australia, by 50g fire assay with inductively coupled plasma mass spectrometry (ICP-MS) analysis (method FA50/MS). High grade samples were additionally analysed by 50g fire assay with inductively coupled plasma optical emission spectroscopy (ICP-OES) (method FA50/OE). Significant assay results are presented in Table 1, drill collar locations are set out in Table 2.

Table 1: Full Assay Results for Downhole Intersections >1g/t Au

|

Hole ID |

From (m) |

To (m) |

Interval (m) |

Au (ppb) |

Au (g/t)* |

Note |

|

CHRC0001 |

21 |

22 |

1 |

2,154 |

||

|

24 |

25 |

1 |

1,344 |

|||

|

33 |

34 |

1 |

12,490 |

10.2 |

||

|

CHRC0002 |

10 |

15 |

5 |

N/A |

Mined out void |

|

|

15 |

16 |

1 |

5,572 |

|||

|

CHRC0003 |

0 |

1 |

1 |

1,816 |

||

|

1 |

2 |

1 |

1,261 |

|||

|

5 |

6 |

1 |

1,251 |

|||

|

6 |

7 |

1 |

44,821 |

47.1 |

||

|

7 |

8 |

1 |

1,360 |

|||

|

CHRC0004 |

0 |

1 |

1 |

1,362 |

||

|

2 |

3 |

1 |

1,911 |

|||

|

3 |

4 |

1 |

1,716 |

|||

|

5 |

6 |

1 |

1,560 |

|||

|

36 |

37 |

1 |

2,377 |

2.526 |

||

|

37 |

39 |

2 |

|

|

Mined out, poor return |

|

|

CHRC0005 |

22 |

23 |

1 |

1,155 |

1.13 |

|

|

52 |

53 |

1 |

1,262 |

|||

|

53 |

54 |

1 |

2,641 |

2.296 |

||

|

CHRC0006 |

25 |

26 |

1 |

8,761 |

5.721 |

|

|

26 |

27 |

1 |

41,037 |

40.625 |

||

|

CHRC0007 |

1 |

2 |

1 |

1,546 |

4.802 |

|

|

5 |

6 |

1 |

1,762 |

1.915 |

||

|

6 |

7 |

1 |

10,933 |

11.272 |

||

|

13 |

14 |

1 |

1,695 |

1.546 |

||

|

54 |

55 |

1 |

12,166 |

11.157 |

||

|

CHRC0008 |

No Significant Values |

|||||

|

CHRC0009 |

49 |

50 |

1 |

2,514 |

|

|

|

50 |

51 |

1 |

2,608 |

1.707 |

*Overlimit assay analysed via Intertek Genalysis FA50/OE (50g Fire-Assay)

Table 2: Tati 2022 Drill Programme Collar Table

|

Drill Hole ID |

Dip |

Azimuth |

Depth (m) |

Northing* |

Easting* |

|

CHRC0001 |

45° |

28° |

40 |

564875 |

7650896 |

|

CHRC0002 |

45° |

35° |

30 |

564856 |

7650925 |

|

CHRC0003 |

45° |

31° |

30 |

564842 |

7650942 |

|

CHRC0004 |

45° |

35° |

60 |

564818 |

7650929 |

|

CHRC0005 |

45° |

52° |

80 |

564797 |

7650937 |

|

CHRC0006 |

45° |

44° |

50 |

564798 |

7650936 |

|

CHRC0007 |

45° |

44° |

70 |

564772 |

7650950 |

|

CHRC0008 |

45° |

35° |

30 |

564748 |

7650986 |

|

CHRC0009 |

45° |

48° |

100 |

564744 |

7650958 |

* Projection: UTM Zone 35S WGS84

Reference Notes

1. Company announcement, Tati Project Botswana – Drill Programme Results, 4 April 2022

( https://polaris.brighterir.com/public/power_metal_resources/news/rns/story/w9klmer )

2. Company announcement, Tati Project Botswana – Large Scale Gold Anomaly Confirmed, 14 September 2021

( https://polaris.brighterir.com/public/power_metal_resources/news/rns/story/w6pve9x )

QUALIFIED PERSON STATEMENT

The technical information contained in this disclosure has been read and approved by Mr Nick O’Reilly (MSc, DIC, MIMMM, MAusIMM, FGS), who is a qualified geologist and acts as the Qualified Person under the AIM Rules – Note for Mining and Oil & Gas Companies. Mr O’Reilly is a Principal consultant working for Mining Analyst Consulting Ltd which has been retained by Power Metal Resources PLC to provide technical support.

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“MAR”), and is disclosed in accordance with the Company’s obligations under Article 17 of MAR.

For further information please visit https://www.powermetalresources.com/ or contact:

|

Power Metal Resources plc |

|

|

Paul Johnson (Chief Executive Officer) |

+44 (0) 7766 465 617 |

|

SP Angel Corporate Finance (Nomad and Joint Broker) |

|

|

Ewan Leggat/Charlie Bouverat |

+44 (0) 20 3470 0470 |

|

SI Capital Limited (Joint Broker) |

|

|

Nick Emerson |

+44 (0) 1483 413 500 |

|

First Equity Limited (Joint Broker) |

|

|

David Cockbill/Jason Robertson |

+44 (0) 20 7330 1883 |

#POW Power Metal Resources PLC – Tati Project Botswana Initial Drill Assay Results

3rd November 2022 / Leave a comment

Power Metal Resources PLC (LON:POW) the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces initial results from the Company’s recently completed drilling programme on the 100% owned and operated Tati Project (“Tati” or the “Project”) located within the Tati Greenstone Belt near Francistown, Botswana.

Power Metal Resources PLC (LON:POW) the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces initial results from the Company’s recently completed drilling programme on the 100% owned and operated Tati Project (“Tati” or the “Project”) located within the Tati Greenstone Belt near Francistown, Botswana.

Paul Johnson, Chief Executive Officer of Power Metal Resources plc commented:

“The Tati Project now covers the formerly producing Cherished Hope gold mine and is within the underexplored Tati Greenstone Belt, where the Company is exploring for near surface, high-grade extensions of the Cherished Hope mine.

The successful intersection of high-grade gold in the three holes for which assay results have been received is very exciting, and the bonanza grade gold assay result already identified naturally inspires us to push ahead with further accelerated exploration work.

Further assay results from the remaining six holes, several of which intersected significant quartz reef intersections (up to 8m thick), are awaited with great interest.“

Highlights:

– A total of nine reverse circulation (“RC”) holes totalling 490m were completed at Tati as part of the August 2022 exploration programme – representing the first ever known drilling programme carried out on prospecting licence (“PL”) 049/2022. Complete assay results have now been received for the first three holes, with results from the six remaining holes expected in the coming weeks.

– Significant near-surface, dolerite and quartz reef hosted gold mineralisation was intersected in all three holes. Key down-hole intersections (>1g/t Au) include:

o Hole CHRC0001

Ø 1m @ 2.15 g/t Au from 21m

Ø 1m @ 1.34 g/t Au from 24m

Ø 1m @ 10.20g/t Au from 33m

o Hole CHRC0002

Ø 1m @ 5.57 g/t Au from 15m

o Hole CHRC0003

Ø 2m @ 1.54 g/t Au from surface

Ø 3m @ 16.77 g/t Au from 5m, including

§ 1m @ 47.17 g/t Au from 6m

– RC hole CHRC0002 was designed to target one of the thicker portions of the quartz reef structure, and due to a shallow dip chosen for the hole it ended up intersecting a mined-out void from 10-15m. The 1m @ 5.6g/t Au from 15m downhole intersection represents the footwall of the main quartz reef structure. The Company is considering steepening the dip and redrilling the section in order to test the entire section of this quartz reef.

– Results for the remaining six holes are pending, including CHRC0007 which returned the single largest quartz reef intersection from 11-19m (8m intersection) of the 2022 drilling programme.

A map highlighting the location of the Tati Project can be found at the link below:

https://www.powermetalresources.com/tati-project-cherished-hope-mine-rc-drilling/

One metre RC chip samples were riffle split and sent for analysis by Intertek Genalysis in Perth Western Australia, by 50g fire assay with inductively coupled plasma mass spectrometry (ICP-MS) analysis (method FA50/MS). High grade samples were additionally analysed by 50g fire assay with inductively coupled plasma optical emission spectroscopy (ICP-OES) (method FA50/OE). Significant assay results are presented in Table 1, drill collar locations are set out in Table 2.

Table 1: Assay Results for Significant Downhole Intersections

|

Hole ID |

From (m) |

To (m) |

Interval (m) |

Au (ppb) |

Au (g/t)* |

Note |

|

CHRC0001 |

0 |

1 |

1 |

688 |

||

|

1 |

2 |

1 |

411 |

|||

|

21 |

22 |

1 |

2,154 |

|||

|

22 |

23 |

1 |

226 |

|||

|

23 |

24 |

1 |

209 |

|||

|

24 |

25 |

1 |

1,344 |

|||

|

29 |

30 |

1 |

987 |

|||

|

33 |

34 |

1 |

12,490 |

10.2 |

||

|

CHRC0002 |

10 |

15 |

5 |

N/A |

Mined out void |

|

|

15 |

16 |

1 |

5,572 |

|||

|

CHRC0003 |

0 |

1 |

1 |

1,816 |

||

|

1 |

2 |

1 |

1,261 |

|||

|

2 |

3 |

1 |

105 |

|||

|

3 |

4 |

1 |

84 |

|||

|

4 |

5 |

1 |

105 |

|||

|

5 |

6 |

1 |

1,251 |

|||

|

6 |

7 |

1 |

44,821 |

47.1 |

||

|

7 |

8 |

1 |

1,360 |

|||

*Overlimit assay analysed via Intertek Genalysis FA50/OE (50g Fire-Assay)

Table 2: Tati 2022 Drill Programme Collar Table

|

Drill Hole ID |

Dip |

Azimuth |

Depth (m) |

Northing* |

Easting* |

|

CHRC0001 |

45° |

28° |

40 |

564875 |

7650896 |

|

CHRC0002 |

45° |

35° |

30 |

564856 |

7650925 |

|

CHRC0003 |

45° |

31° |

30 |

564842 |

7650942 |

|

CHRC0004 |

45° |

35° |

60 |

564818 |

7650929 |

|

CHRC0005 |

45° |

52° |

80 |

564797 |

7650937 |

|

CHRC0006 |

45° |

44° |

50 |

564798 |

7650936 |

|

CHRC0007 |

45° |

44° |

70 |

564772 |

7650950 |

|

CHRC0008 |

45° |

35° |

30 |

564748 |

7650986 |

|

CHRC0009 |

45° |

48° |

100 |

564744 |

7650958 |

* Projection: UTM Zone 35S WGS84

QUALIFIED PERSON STATEMENT

The technical information contained in this disclosure has been read and approved by Mr Nick O’Reilly (MSc, DIC, MIMMM, MAusIMM, FGS), who is a qualified geologist and acts as the Qualified Person under the AIM Rules – Note for Mining and Oil & Gas Companies. Mr O’Reilly is a Principal consultant working for Mining Analyst Consulting Ltd which has been retained by Power Metal Resources PLC to provide technical support.

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“MAR”), and is disclosed in accordance with the Company’s obligations under Article 17 of MAR.

For further information please visit https://www.powermetalresources.com/ or contact:

|

Power Metal Resources plc |

|

|

Paul Johnson (Chief Executive Officer) |

+44 (0) 7766 465 617 |

|

SP Angel Corporate Finance (Nomad and Joint Broker) |

|

|

Ewan Leggat/Charlie Bouverat |

+44 (0) 20 3470 0470 |

|

SI Capital Limited (Joint Broker) |

|

|

Nick Emerson |

+44 (0) 1483 413 500 |

|

First Equity Limited (Joint Broker) |

|

|

David Cockbill/Jason Robertson |

+44 (0) 20 7330 1883 |

#POW Power Metal Resources PLC – Kalahari Key Botswana – Acquisition Update

28th October 2022 / Leave a comment

Power Metal Resources PLC (LON:POW) the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces an update in respect of the acquisition of an additional 58.7% interest in Kalahari Key Mineral Exploration PTY Limited (“Kalahari Key” or “KKME”) (the “Transaction”).

Power Metal Resources PLC (LON:POW) the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces an update in respect of the acquisition of an additional 58.7% interest in Kalahari Key Mineral Exploration PTY Limited (“Kalahari Key” or “KKME”) (the “Transaction”).

Kalahari Key has a single project 60% interest in the Molopo Farms Complex Project (the “Project’ or “Molopo Farms”) targeting a large-scale nickel – platinum group metal (“PGM”) discovery in southwest Botswana.

The conditional acquisition was originally announced on 18 May 2022 which may be viewed through the following link:

https://www.londonstockexchange.com/news-article/POW/kalahari-key-botswana-acquisition/15458701

HIGHLIGHTS:

– The Company has received written confirmation that all Botswana regulatory approvals required to enable the Transaction to proceed have now been received.

– Following receipt of the approvals the Company is now working with the Kalahari Key Board and advisers in Botswana to complete the Transaction.

– Following Transaction completion, Power Metal will hold an 87.71% interest in Kalahari Key which will hold a 100% interest in Molopo Farms.

– A further announcement to follow shortly including confirmation of the issue of equity consideration to Kalahari Key shareholders disposing of their interest to Power Metal.

Paul Johnson, Chief Executive Officer of Power Metal Resources PLC, commented:

“The receipt of all Botswana regulatory approvals for the Transaction is a significant event for the Company, and after the various administrative tasks are completed Power Metal will hold an 87.71% interest in Kalahari Key.

On behalf of Power Metal I would like to thank the authorities in Botswana and our advisers for their handling of the approvals process, and the Kalahari Key team who are working with us to complete the Transaction.

Shareholders will be aware we are currently undertaking the largest drill programme the Company has conducted at Molopo Farms and to complete the Transaction at this juncture is particularly significant.

Further announcements will follow with regard to Transaction completion and with operational updates from the Molopo Farms ongoing drill programme.”

Further information in respect of Molopo Farms may be viewed on the Company’s website through the following link:

https://www.powermetalresources.com/project/molopo-farms-complex/

In addition photographs and videos from the Project are and will be available on the Company’s website gallery section, through the following link:

https://www.powermetalresources.com/investors/gallery/molopo-farms-complex-botswana/

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“MAR”), and is disclosed in accordance with the Company’s obligations under Article 17 of MAR.

For further information please visit https://www.powermetalresources.com/ or contact:

|

Power Metal Resources plc |

|

|

Paul Johnson (Chief Executive Officer) |

+44 (0) 7766 465 617 |

|

SP Angel Corporate Finance (Nomad and Joint Broker) |

|

|

Ewan Leggat/Charlie Bouverat |

+44 (0) 20 3470 0470 |

|

SI Capital Limited (Joint Broker) |

|

|

Nick Emerson |

+44 (0) 1483 413 500 |

|

First Equity Limited (Joint Broker) |

|

|

David Cockbill/Jason Robertson |

+44 (0) 20 7330 1883 |

NOTES TO EDITORS

Power Metal Resources plc – Background

Power Metal Resources plc (LON:POW) is an AIM listed metals exploration company which finances and manages global resource projects and is seeking large scale metal discoveries.

The Company has a principal focus on opportunities offering district scale potential across a global portfolio including precious, base and strategic metal exploration in North America, Africa and Australia.

Project interests range from early-stage greenfield exploration to later-stage prospects currently subject to drill programmes.

Power Metal will develop projects internally or through strategic joint ventures until a project becomes ready for disposal through outright sale or separate listing on a recognised stock exchange thereby crystallising the value generated from our internal exploration and development work.

Value generated through disposals will be deployed internally to drive the Company’s growth or may be returned to shareholders through share buy backs, dividends or in-specie distributions of assets.

Exploration Work Overview

Power Metal has multiple internal exploration programmes completed or underway, with results awaited. The status for each of the Company’s priority exploration projects is outlined in the table below.

|

Project |

Location |

Current POW % |

Work Completed or Underway |

Results Awaited |

|

Athabasca Uranium |

Canada |

100% |

Ground exploration programme complete at 3 properties. Preliminary planning for work in Spring/Summer 2023 is ongoing. |

Assay results from samples collected during fieldwork. |

|

Molopo Farms |

Botswana |

87.71%# |

T1-6 conductor target drilling underway. Further MLEM surveys planned over additional AEM targets identified. |

Drill programme updates and findings from further MLEM survey work. |

|

Tati Project |

Botswana |

100% |

RC drilling and sampling of mine dumps complete. |

Review of mine dumps sampling and assay results from RC drill programme. |

# following completion of administrative processes for share transfer and restructuring

Exploration work programmes may also be underway within Power Metal investee companies and planned IPO vehicles where Power Metal has a material interest, the findings from which will be released on their respective websites, with simultaneous updates through Power Metal regulatory announcements where required. These interests are summarised in the table below:

#POW Power Metal Resources Plc- Golden Metal Resources – Golconda Gold Anomalies

27th October 2022 / Leave a comment

Power Metal Resources PLC (LON:POW) the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces an update from Golden Metal Resources PLC (“Golden Metal” or “GMT”), the Company’s 83.13% owned subsidiary, which is planning to list on the London capital markets this quarter.

Power Metal Resources PLC (LON:POW) the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces an update from Golden Metal Resources PLC (“Golden Metal” or “GMT”), the Company’s 83.13% owned subsidiary, which is planning to list on the London capital markets this quarter.

The most recent update from Golden Metal was released on 26 August 2022 and can be found at the link below:

HIGHLIGHTS:

-Recently obtained historical dataset from a high-resolution geochemical soil survey covering the entirety of the Golconda Summit Project (“Golconda Summit” or the “Project”), has highlighted three zones of strongly anomalous arsenic and gold mineralisation for further investigation.

-Rock sample assay results from a geological mapping and sampling programme over Golconda Summit, undertaken by Golden Metal’s in-country senior geological consultant, have confirmed strong arsenic (pathfinder for Carlin-type gold mineralisation) and gold anomalism.

-At the Garfield Project assay results are pending for the recently completed soil geochemical survey.

-At the Pilot Mountain Project three-dimensional (“3D”) modelling of the high-resolution induced polarisation (“IP”) geophysics survey data collected over Golden Metal’s flagship project has been commissioned, with results eagerly awaited.

Oliver Friesen, Chief Executive Officer of Golden Metal Resources PLC, commented:

“Our 100% owned flagship Pilot Mountain Project has been a source of particular focus for GMT and our investors, with good reason, as we continue to engage in various discussions regarding possible technical and financial engagement at a project level.

Work has continued in parallel across GMT’S other Nevada interests and today’s update is focused on significant gold anomalism confirmed across the Golconda Summit Project where we are targeting a Carlin-type gold discovery.

Review of newly acquired historical datasets, together with recently completed detailed geological mapping and rock sampling at Golconda Summit have delivered clear evidence of gold and arsenic anomalism. These results, in GMT’s technical view, further underpin the strong value proposition associated with bringing this compelling gold opportunity to UK investors alongside the rest of our exciting Nevada focused project portfolio.

We are seeing a steady improvement of market conditions, and particularly those surrounding junior mining and exploration companies. As a result, we are seeking to secure the UK listing of Golden Metal Resources as soon as possible.

Paul Johnson, Chief Executive Officer of Power Metal Resources PLC, commented:

“The news from Golconda Summit today is the first key set of exploration results, and they have ratified our belief in the potential of the Project to host a Carlin-type gold deposit. As a result, Golconda has been designated as a priority Project for follow-on exploration and subsequent drilling.

The combination of the strategically significant Pilot Mountain Project combined with the blue-sky exploration upside offered by Golconda Summit, as confirmed today, makes Golden Metal, in our view, a unique investment proposition focused on Nevada, USA and we look forward to the planned listing in London.“

Further Information: Golconda Summit

Within Carlin-type gold deposits, which are found almost exclusively within northern Nevada, there are multiple alteration minerals that are typically found proximal and near to Carlin-type gold deposits. The most notable of these is arsenic, so as a result arsenic anomalism is often one of the best proxies when looking for Carlin-type gold deposits. Additionally, arsenic is considered to be highly mobile (compared to gold) and therefore arsenic can more easily be remobilised along fluid conduits away from Carlin-type mineralised systems.

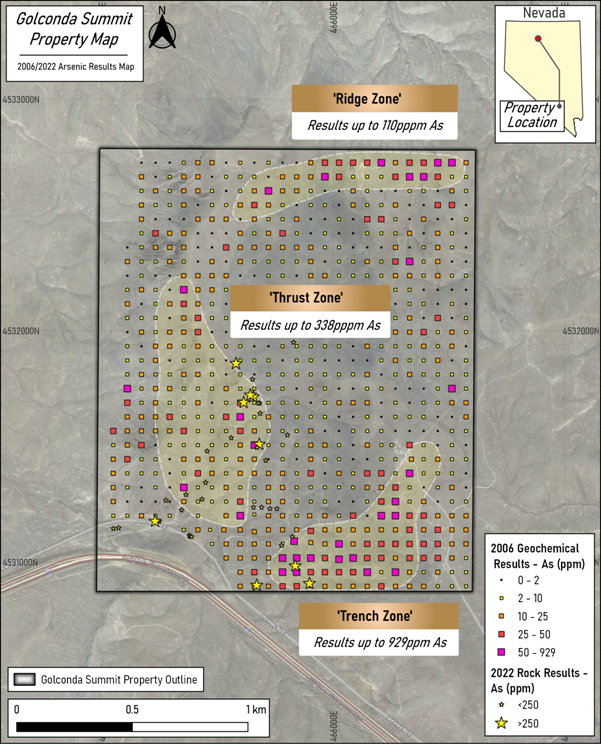

Geochemical Sampling

Golden Metal have obtained the dataset for a high-resolution (60m x 60m sample spacing) soil geochemical survey completed across the entire Golconda Summit Project in 2006. This historical geochemical dataset includes 741 multi-element assay results from which three discrete anomalous zones have been identified: ‘Trench’, ‘Thrust’, and ‘Ridge’ zones. These zones are defined by the arsenic and gold results, of which there is a strong correlation noted. The ‘Trench’ zone is coincident with historical trenching completed within the Project, while little historical work is known to have been completed within the ‘Thrust’ and ‘Ridge’ zones (see Figure 1).

‘Trench Zone’ – Strong arsenic and gold anomalism was identified with individual results up to 929ppm As and 1846ppb Au (1.846g/t; Sample GS-358).

‘Thrust Zone’ – Strong arsenic and gold anomalism was identified with results up to 338ppm As and 402ppb Au (Sample GS-134).

‘Ridge Zone’ – Strong arsenic and gold anomalism was identified with results up to 110ppm As and 782ppm Au (Sample GS-679).

Rock Sampling/Mapping

Detailed mapping and rock sampling was recently completed across Golconda Summit by Golden Metals’ in-country senior geological consultant. A total of 41 individual rock samples were taken, and detailed mapping of the easterly dipping iron-point thrust fault was completed. Most of the sampling was done within or near to the ‘Thrust Zone’. Strong arsenic and gold anomalism was identified within multiple samples, and in particular within five samples that are within the mapped iron-point thrust fault.

As with the geochemical results, a strong correlation between arsenic and gold results was noted. Of the 41 samples collected, 9 samples returned >250ppm As, with 6 samples returning >500ppm As (500ppb represents upper limits of analysis technique used). The three top gold results from the rock sampling completed were all from samples that returned >250ppm As (838, 335, and 280ppb Au).

Geological Model

At Golconda Summit, GMT’s geological consultant has completed several weeks of detailed mapping and has identified the presence of the Iron Point thrust fault. This thrust fault has controlled the emplacement of non-reactive ‘upper plate’ rocks, over top of reactive ‘lower plate’ rocks. Encouragingly (see Figure 2), a very strong arsenic anomalism within rock and soil sample results is coincident with the surface expression of the Iron Point thrust fault. The postulation is that there has been remobilisation of Carlin-type fluids up along the Iron Point thrust fault – with the view that one would need to drill test east of this thrust fault. Interestingly, the ‘Trench Zone’ is located with this drill target zone, and here, historical trenching completed by Nerco Mining Company in 1989 returned up to 7.6m of 19.7g/t Au within non-reactive ‘upper plate’ rocks. Secondary sub-vertical faults have been mapped across this trench area which could have controlled the remobilisation of Carlin-type gold from reactive ‘lower-plate’ rocks below.

Trenching as well as follow-up reverse circulation (“RC”) drilling is planned post the planned listing of Golden Metal. Golden Metal will be the first company to ever drill test at Golconda multiple prospective ‘lower plate’ units including the Antler Peak limestone, Edna Mountain and Preble Formations, all of which host Carlin-type gold deposits elsewhere in Northern Nevada.

Figure 1 – Golconda Summit: A plan map of the Project area including the recently obtained 2006 geochemical results as well as 2022 rock sampling results. Arsenic is a strong pathfinder for gold within Carlin-type gold deposits.

Figure 2 – Golconda Summit: A plan map of the Project showing the location of the ‘Ridge’, ‘Thrust’ and ‘Trench’ zones in relation to the major iron-point thrust fault which has been mapped across the Project.

The diagrams and images presented above may be viewed on GMT’s website and may be reached through the following link:

https://www.goldenmetalresources.com/project/the-golconda-summit-project/

Further photographs and videos from the drill programme are and will be available on the Company’s website gallery section, through the following link:

https://www.goldenmetalresources.com/investors/gallery/golconda-summit-project/

QUALIFIED PERSON STATEMENT

The technical information contained in this disclosure has been read and approved by Mr Nick O’Reilly (MSc, DIC, MIMMM, MAusIMM, FGS), who is a qualified geologist and acts as the Qualified Person under the AIM Rules – Note for Mining and Oil & Gas Companies. Mr O’Reilly is a Principal consultant working for Mining Analyst Consulting Ltd which has been retained by Power Metal Resources PLC to provide technical support.

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“MAR”), and is disclosed in accordance with the Company’s obligations under Article 17 of MAR.

For further information please visit https://www.powermetalresources.com/ or contact:

|

Power Metal Resources plc |

|

|

Paul Johnson (Chief Executive Officer) |

+44 (0) 7766 465 617 |

|

SP Angel Corporate Finance (Nomad and Joint Broker) |

|

|

Ewan Leggat/Charlie Bouverat |

+44 (0) 20 3470 0470 |

|

SI Capital Limited (Joint Broker) |

|

|

Nick Emerson |

+44 (0) 1483 413 500 |

|

First Equity Limited (Joint Broker) |

|

|

David Cockbill/Jason Robertson |

+44 (0) 20 7330 1883 |

#POW Power Metal Resources PLC – FDR Australia – Wallal Drill Clearance & Update

27th October 2022 / Leave a comment

Power Metal Resources plc (LON:POW), the London listed exploration company seeking large-scale metal discoveries across its global project portfolio, provides an update to shareholders in respect of its interests in the Paterson Province of Western Australia (the “Paterson Interests”) held through its 62.12% subsidiary First Development Resources PLC (“FDR”) which is seeking a planned listing on the London capital markets.

This update relates specifically to the Wallal Project (“Wallal” or the “Project”), one of three Paterson Province projects held by FDR and includes the Wallal Tenements (E45/5816, E45/5853 and E45/5880) (the “Tenements”).

Highlights

· The Heritage Clearance Survey at Wallal, completed under the supervision of the Yamatji Marlpa Aboriginal Corporation and the Nyangumarta people in September 2022 has confirmed site establishment works for drilling may now proceed.

· FDR have immediately mobilised an operational team to site to the eastern magnetic bullseye anomaly identified during the in-depth desktop review (the “Eastern Anomaly) to establish access and to prepare the drilling pad, enabling the commencement of diamond drilling which is expected to follow immediately after the listing of FDR in the London capital markets.

· The Phase I diamond core drilling programme has been designed to initially test the Eastern Anomaly, which is interpreted to consist of two lobes which result in a distinct target area of approximately 2.5km x 2.5km, targeting a large-scale gold-copper discovery.

Tristan Pottas Chief Executive Officer of First Development Resources plc commented:

“The completion of the Heritage Clearance Survey provides FDR with the final approval required to proceed with the Phase I diamond core drilling programme at FDR’s flagship Wallal Project in the Paterson province.

I would personally like to thank all the key stakeholders and consultants who have helped us get to this decisive point in the evolution of FDR, particularly the Nyangumarta people and Yamatji Marlpa Aboriginal Corporation.

On receipt of the final report, we have immediately engaged the services of an earthworks contractor to prepare the site to enable our drilling partner DDH1 to commence drilling at the earliest convenience following our planned UK listing.”

Paul Johnson Chief Executive Officer of Power Metal Resources plc commented:

“Without question this is an exciting time for the Power Metal and FDR teams as we close in on listing, an event which will be followed with drilling at Wallal targeting a large-scale gold-copper discovery.

From day one to date, FDR have demonstrated their intention to deploy capital immediately into the ground to improve the understanding of the various targets across their project portfolio. This is a mindset that I expect to continue after the planned UK listing.”

FURTHER INFORMATION

FIGURE 1: Paterson Province Tenement Map

FIGURE 2: Wallal Geophysical Anomaly Map

FIGURE 3: 3D View to the North of the Eastern Anomaly

The diagrams and images presented above may be viewed on FDR’s website and may be reached through the following link:

https://firstdevelopmentresources.com/project/wallal-project/

Further photographs and videos are and will be available on FDR’s website gallery section, through the following link:

https://firstdevelopmentresources.com/investor-centre/gallery/

WALLAL HERITAGE CLEARANCE SURVEY

The Heritage Clearance Survey (the “Survey”) was completed at Wallal between 12-15 September 2022. The original Survey request which included a detailed description of the Phase I diamond core drilling programme and site-specific maps was submitted to Yamatji Marlpa Aboriginal Corporation (“YMAC”) by the Company’s appointed Exploration Manager on 31 January 2022. The Survey is a required precursor to the planned Phase I diamond core drilling programme at the company’s Wallal project located in the Paterson Province of Western Australia.

The Survey was completed in accordance with Section 18 of the Aboriginal Heritage Act 1972 and in accordance with the terms of the Heritage Agreement in place with YMAC as agent for the Nyangumarta Warrarn Aboriginal Corporation. The Survey was undertaken with the full involvement of Nyangumarta representatives. As native title holders the Nyangumarta possess rights and interests according to traditional law and custom including the right to be fully informed about activities on their country and to speak about their country.

The Survey team, appointed by YMAC, included representatives from Nyangumarta, a YMAC archaeologist, a consulting anthropologist, and members of FDR senior management team. Two 400m x 400m areas were surveyed covering the two planned drill locations designed to initially test the Eastern anomaly (“Area A”) and the secondary target, the Border anomaly (“Area B”). In addition to the drill sites, the Survey also covered the route of new tracks necessary to access the drill locations. At both drill locations additional east-west orientated survey grids (measuring 2.73km x 4km at Area A and 1.27km x 4km at Area B) were delineated to facilitate potential future on-ground geophysical surveys.

Following the Survey, the Nyangumarta representatives asserted that the work programme proposed at Area A and Area B, was clear of ethnographic and archaeological sites or concerns and that the proposed works programme could proceed.

SITE ESTABLISHMENT AND ACCESS

Following receipt of the Heritage Clearance Survey Report a team led by the FDR’s Exploration Manager has been mobilised to Wallal to prepare the site in preparation for drilling which is scheduled to commence immediately following FDR’s proposed UK listing.

To enable site works to proceed efficiently, the existing access track which links the drilling sites to the well-maintained Nyangumarta Highway, will require minor earthwork improvements and the drill pads and camp accommodation areas will be levelled and prepared ahead of drill contractor mobilisation

Both the access and the drill pad location were surveyed during the recent Heritage Clearance Survey. Site clearance is expected to take approximately three days to complete.

WALLAL PHASE I DIAMOND CORE DRILLING PROGRAMME

FDR’s Phase I diamond core drilling programme has been designed in conjunction with Perth based consultancy Resource Potentials Pty Ltd (“Resource Potentials”). The programme is targeting the Proterozoic basement rocks below the Permian Grant Group which are believed to host the sources of the magnetic bullseye anomalies identified during the completion of an in-depth review of all geological and geophysical data associated with the Wallal project area.

Three magnetic bullseye anomalies were identified in the review, the Western, Eastern and Border anomalies. The magnetic bullseye anomalies are of particular interest due to their possible geological similarities to the regionally significant Havieron discovery (Greatland Gold – Newcrest Joint venture).

The Havieron deposit is coincident with a magnetic bullseye anomaly detected by an airborne magnetic survey and has a similar amplitude to Wallal, approximately 100nanoTesla (“nT”) for the Eastern Anomaly and 80nT for Havieron.

The Phase I diamond core drilling programme has been designed to initially test the Eastern Anomaly. The Eastern Anomaly is interpreted to consist of two lobes which result in a distinct target area of approximately 2.5km x 2.5km. An estimate of depth of the cover sequence has been used to constrain the modelled depth of approximately 800 metres to the top of the Eastern magnetic source body.

The Phase I diamond core drilling programme will consist of a minimum of two sub-vertical boreholes totalling approximately 2,720 metres, which will be drilled using rotary open hole to about 150 metres downhole depth and then full core drilling techniques there onwards.

Depending on ground conditions encountered, it is expected that the holes will be commenced using reverse circulation drilling techniques, followed by 83mm (PQ3) or 61.1mm (HQ3) diameter core with a 50.5mm (NQ2) tail to total depth. The parameters for the planned boreholes are set out in Table 1:

Table 1: Planned Wallal Phase I diamond core drillhole parameters

|

DRILLHOLE ID |

EASTING |

NORTHING |

AZIMUTH (°) |

DIP (°) |

NOMINAL DEPTH (m) |

|

DH1 |

260325 |

7780690 |

90 |

80 |

1,220 |

|

DH2 |

259850 |

7780772 |

270 |

80 |

1,500 |

QUALIFIED PERSON STATEMENT

The technical information contained in this disclosure has been read and approved by Mr Nick O’Reilly (MSc, DIC, MIMMM, MAusIMM, FGS), who is a qualified geologist and acts as the Qualified Person under the AIM Rules – Note for Mining and Oil & Gas Companies. Mr O’Reilly is a Principal consultant working for Mining Analyst Consulting Ltd which has been retained by Power Metal Resources PLC to provide technical support.

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“MAR”), and is disclosed in accordance with the Company’s obligations under Article 17 of MAR.

For further information please visit https://www.powermetalresources.com/ or contact:

|

Power Metal Resources plc |

|

|

Paul Johnson (Chief Executive Officer) |

+44 (0) 7766 465 617 |

|

SP Angel Corporate Finance (Nomad and Joint Broker) |

|

|

Ewan Leggat/Charlie Bouverat |

+44 (0) 20 3470 0470 |

|

SI Capital Limited (Joint Broker) |

|

|

Nick Emerson |

+44 (0) 1483 413 500 |

|

First Equity Limited (Joint Broker) |

|

|

David Cockbill/Jason Robertson |

+44 (0) 20 7330 1883 |

#POW Power Metal Resources PLC – Molopo Farms Complex Project Update

30th September 2022 / Leave a comment

Power Metal Resources PLC (LON:POW), the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces an update in relation to the Molopo Farms Complex Project (“Molopo Farms” or the “Project”) targeting a large-scale nickel-copper-platinum group element (“PGE”) discovery in southwestern Botswana.

Power Metal Resources PLC (LON:POW), the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces an update in relation to the Molopo Farms Complex Project (“Molopo Farms” or the “Project”) targeting a large-scale nickel-copper-platinum group element (“PGE”) discovery in southwestern Botswana.

On 28 September 2022 the Company announced an update regarding the delineation of a second major conductor at target area T2-3, as well as an update regarding its ongoing geophysics programme. The link to this announcement is below:

https://www.londonstockexchange.com/news-article/POW/molopo-farms-complex-project-update/15647138

The above update noted that further analyses in respect of target (T1-3) were ongoing, the results of which are now covered below.

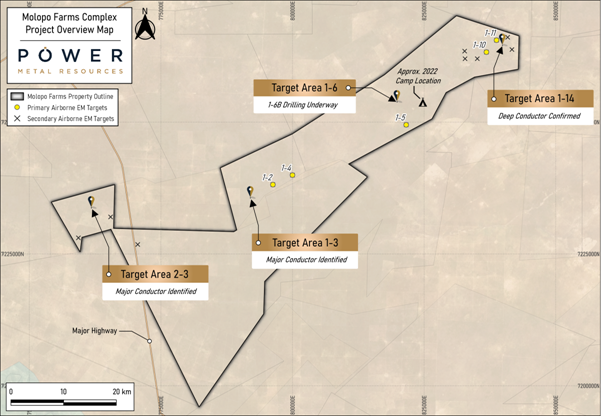

KEY HIGHLIGHTS

T1-3 Major Drill Target

– Final compilation and analyses of the ground-based moving loop electromagnetic (“MLEM”) and magnetic geophysical surveys over target area T1-3 are now complete.

– Geophysical inversion of the MLEM data has highlighted a significant ‘jelly-bean’ shaped, geophysical conductor at target area T1-3. This conductor remains open to the east-west and sits within a magnetic trough observed in both the ground and airborne magnetic surveys. No drilling has ever been completed over this target area.

– Historical airborne electromagnetic (“AEM”) data over T1-3 have been further analysed with results showing the MLEM conductor may extend out to 1.6km in an east-west direction, based on coincident airborne/ground survey anomalies.

– The T1-3 conductor has been given a high-priority (A+) ranking by the Company, the same priority attributed to the conductor at T1-6 (where drilling is ongoing) as well as the new conductor identified at T2-3.

– A planned 450m diamond core drillhole, DDH1-3A, has been designed to intersect the T1-3 conductor at approximately 300m downhole depth. The Company has added this hole to the list of holes to be drilled during the ongoing 2022 campaign. Considering the proximity of T1-3 to ongoing drilling at T1-6 (33km southwest), it is possible that T1-3 will be drilled after holes DDH1-6B and DDH1-6C complete, with drilling at T2-3 to follow (see map for relative locations).

Paul Johnson, Chief Executive Officer of Power Metal Resources commented:

“The inventory of high priority A+ ranked drill targets at Molopo are building and we now have the third, T1-3, added to the list. We plan to drill all three high priority targets during the current drill programme.

Our review has also identified further targets which we believe could become additional priority drill targets subject to additional technical work over those areas.

Each priority conductor identified to date, including T1-6, T1-3 and T2-3, are located proximal to a geological feeder zone but each possess unique size and scale dimensions. By drilling all of these targets, the Project becomes inherently de-risked, and the prospect of a discovery or discoveries increases.

Our attention is principally focused on drilling, with our first drill hole into the T1-6 conductor underway and I look forward to providing further updates at the earliest opportunity.”

GEOPHYSICAL SURVEY – OVERVIEW

– Spectral Geophysics have now completed the 2022 Phase I & II exploration programmes which included four MLEM and four magnetic geophysics surveys over targets T1-6, T1-14 and T2-3 and T1-3. The MLEM and magnetic survey results are assisting the company in refining further drill collar locations for the ongoing 2022 diamond drilling campaign.

– To date, the MLEM survey results have now highlighted:

o T2-3 (A+): A flat-lying, slightly concave (downward), conductor which remains open in all directions. Drilling is planned at this target.

o T1-6 (A+): A large, southerly dipping conductor which remains open towards the south, east and west. Drilling is ongoing over this target.

o T1-3 (A+): A ‘jelly-bean’ shaped conductor which remains open towards the east and west. Drilling is planned at this target.

o T1-14 (B): A conductor which is near-to the contact zone with known Transvaal carbonaceous mudstones. Due to the estimated depth required to reach this conductor (approx. 650m) and the geological complexity associated with this area, it has been given a lower priority ranking than T2-3, T1-6 and T1-3.

– The Company has also completed an in-depth review of a historical AEM report covering the majority of the Molopo Farms Complex Project. Considering priority areas T1-6, T2-3 and T1-3 were originally identified by the historical AEM survey results, it was decided that further investigation of the targets identified by this report were warranted. Significantly, five of the strong AEM conductors, including T1-2, T1-4, T1-5, T1-10 and T1-11 have been upgraded and are now classified as priority airborne targets by the Company. At T1-11, a 2020/2021 drillhole (KKME1-11) completed by the previous operator was determined to not have adequately targeted this conductor. The Company is in ongoing discussions with its geophysical contractor to determine next steps over these target areas.

FURTHER INFORMATION

Figure 1 – Molopo Farms Complex Project Plan Map: A plan map of the Project area, including the location of various elements mentioned above is outlined in Figure 1 below.

Figure 2 – Priority Target Area T1-3 3D View: A 3D view showing the location of the planned drillhole DDH1-3A and the MLEM results (new conductor in blue). The red-pink block model are magnetic inversion results showing the new ‘jelly-bean’ shaped conductor sits within a magnetic trough.

The diagrams and image presented above may also be viewed on the Company’s website through the following link:

https://www.powermetalresources.com/molopo-farms-major-drill-target-t1-3/

Further photographs and videos from the drill programme are and will be available on the Company’s website gallery section, through the following link:

https://www.powermetalresources.com/investors/gallery/molopo-farms-complex-botswana/

PROJECT BACKGROUND AND OWNERSHIP

Power Metal currently has a current circa 53% effective economic interest in Molopo, held through a direct project interest and a shareholding in partner Kalahari Key Mineral Exploration (Pty) Ltd (“KKME”). On 18 May 2022 Power Metal announced a conditional transaction that would see its interest in Molopo Farms increasing to 87.71% (the “Transaction”). The announcement may be viewed through the following link:

https://www.londonstockexchange.com/news-article/POW/kalahari-key-botswana-acquisition/15458701

As part of the Transaction, Power Metal will become the Project operator and in advance of completion the Company is working with the team at KKME to maintain momentum with regard to Project exploration.

Work streams are also in process to secure Botswana regulatory approvals enabling the Transaction to complete.

QUALIFIED PERSON STATEMENT

The technical information contained in this disclosure has been read and approved by Mr Nick O’Reilly (MSc, DIC, MIMMM, MAusIMM, FGS), who is a qualified geologist and acts as the Qualified Person under the AIM Rules – Note for Mining and Oil & Gas Companies. Mr O’Reilly is a Principal consultant working for Mining Analyst Consulting Ltd which has been retained by Power Metal Resources PLC to provide technical support.

REFERENCES

1: Power Metal PLC announcement, Molopo Farms Complex Project, Botswana – Major Drill Target T2-3

(https://www.londonstockexchange.com/news-article/POW/molopo-farms-complex-project-update/15647138)

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“MAR”), and is disclosed in accordance with the Company’s obligations under Article 17 of MAR.

For further information please visit https://www.powermetalresources.com/ or contact:

|

Power Metal Resources plc |

|

|

Paul Johnson (Chief Executive Officer) |

+44 (0) 7766 465 617 |

|

SP Angel Corporate Finance (Nomad and Joint Broker) |

|

|

Ewan Leggat/Charlie Bouverat |

+44 (0) 20 3470 0470 |

|

SI Capital Limited (Joint Broker) |

|

|

Nick Emerson |

+44 (0) 1483 413 500 |

|

First Equity Limited (Joint Broker) |

|

|

David Cockbill/Jason Robertson |

+44 (0) 20 7330 1883 |

#POW Power Metal Resources – Uranium Portfolio Update – Athabasca Basin

14th January 2022 / Leave a comment

Power Metal Resources PLC (LON:POW) the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces an update on its uranium portfolio which includes seven 100% owned interests (the “Portfolio” or “Properties”) covering 411.96km2 surrounding the Athabasca Basin in northern Saskatchewan, Canada.

Further information in respect of the Properties, including a location map may be viewed in the website link below:

https://www.powermetalresources.com/project/athabasca-basin/

Portfolio Updates:

– Power Metal has completed an in-depth historic data compilation across its entire uranium Portfolio surrounding the prolific Athabasca Basin, Saskatchewan, and now possesses a robust fully-digitised database covering all historic work programmes completed across the various Properties.

– Power Metal recently retained a UK-based geological consultant with extensive Athabasca Basin experience to help push forward the Company’s various initiatives and projects within the exciting uranium space. The consultant previously completed a M.Sc. thesis from the University of Ottawa where they researched the geochemistry, alteration, and structural geology of one of the many world-class unconformity-related uranium deposits located within the Athabasca Basin.

– Several extensive historical datasets were successfully procured, the data from which, combined with the results obtained from the recently completed Phase I work programme, will allow the Company to begin planning various 2022 exploration initiatives across the Portfolio.

– Further maps and highlights from across the Portfolio will be released by the Company in the coming months. Select findings from the historic data compilation programme for the Tait Hill Property are however highlighted below, demonstrating the information gathered for one property.

– Reflecting the interest shown from third parties in the Properties, a dataroom is being prepared to provide a focal point for those parties wishing to undertake due diligence review.

Paul Johnson, Chief Executive Officer of Power Metal Resources plc commented:

“Our move into uranium exploration has been planned for some time and commenced with the September 2021 staking surrounding the Athabasca Basin. The staking undertaken was highly selective, focusing on areas where historical recorded work had demonstrated uranium mineralisation or where other geological features suggested that ground would be prospective.

Although selective, the seven properties are clearly attracting some interest and we are looking at potential commercialisation options alongside planning for proactive 2022 exploration programmes.

To maximise any commercial outcome, and to optimise exploration we have gathered as much data as possible in respect of the Properties, and the information gleaned is, in our view, highly valuable.”

Tait Hill Property (“Tait Hill” or the “Property”) Data Compilation Highlights

– All data from an high-resolution airborne magnetic, electromagnetic, and radiometric survey flown by Terraquest Ltd., on behalf of Canalaska Uranium Ltd., was obtained by Power Metal. The 2008 high-resolution survey included 4,290 total line-km flown at 150m line-spacing which covers the entire modern day Tait Hill Property.1

– Detailed analysis was undertaken by Canalaska Uranium Ltd., for various radiometric products produced by the airborne survey including uranium (U), thorium (Th) and potassium (K). Specifically, isolated points in the dataset which have high U/Th ratios relative to background, are considered good candidates for uranium-rich surface showings and should be prioritised during future work programmes.1 A total of 11 unique points were identified by the survey within the Tait Hill Property.

– The airborne survey (1st vertical derivative product) highlights multiple northwest-southeast trending magnetic high features which transect the Property. Mapping over the area determined that they correspond to uranium-rich granite and pegmatitic dykes with anomalous scintillometer readings ranging from 350 to 2,500 counts per second (“CPS”). Further investigation is warranted along these structures which are mapped for a combined 16km through the Property.2

– Several zones of uranium-rich mineralisation were identified in the historic results from Tait Hill including rock samples up to 15,150ppm (1.52%), 7,653ppm, and 6,610ppm U, as well as uranium in soil samples up to 14,358ppm (1.44%), 7,049ppm, and 6,692ppm.2,3

– The rock sample that returned 15,150ppm U was taken immediately west of Tait Lake, and was located along a northeast-southwest oriented uranium-rich boulder train which follows the general direction of ice movement in the region (southwest). It was recommended that additional work be completed on this boulder train as further work may lead to the possible source area for these uranium-rich boulders.2

– A new high-priority zone was identified during the 2008 field campaign which was named the ‘NE Shearika Zone’. Here, several uranium-rich rock samples (including 7,654ppm, 6,611ppm, 3,633ppm, and 1,609ppm U) were collected along a sharp contact zone between a granitic intrusion (magnetic high) and the surrounding meta-sedimentary rocks (magnetic low). This contact zone is traced for over 3km within the Tait Hill Property.3

A map highlighting some of the results from the historic data compilation completed on the Tait Hill Property can be found at the following link:

Tait Hill Historic Data Compilation Map|Power Metal Resources plc (LON: POW)

Reference Notes:

1: Operations Report for Canalaska Uranium Ltd., High Resolution Magnetic, XDS VLF-EM & Radiometric Airborne Survey Grease River Project Northern Saskatchewan: April 15, 2008

2: Canalaska Uranium, Report on the 2007 Exploration Programme Grease River Project: July, 2008

3: Canalaska Uranium, Report on the 2008 Exploration Programme Grease River Project: March, 2009

COMPETENT PERSON STATEMENT

The technical information contained in this disclosure has been read and approved by Mr Nick O’Reilly (MSc, DIC, MIMMM, MAusIMM, FGS), who is a qualified geologist and acts as the Competent Person under the AIM Rules – Note for Mining and Oil & Gas Companies. Mr O’Reilly is a Principal consultant working for Mining Analyst Consulting Ltd which has been retained by Power Metal Resources PLC to provide technical support.