Home » Posts tagged 'Paul Johnson'

Tag Archives: Paul Johnson

Power Metal Resources #POW – Insider Warrant Update

25th April 2023 / Leave a comment

Power Metal Resources plc (LON:POW) the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces a warrant update.

Power Metal Resources plc (LON:POW) the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces a warrant update.

The Company would refer readers to its announcement of 24 October 2022 wherein warrants to subscribe for new ordinary shares of 0.1p in Power Metal at an exercise price of 0.75p per share (“Insider Warrants”), held by Company directors, could not be exercised at the original expiry date of 20 July 2022 (“July 2020 Warrants”) and were extended to an expiry date of 21 April 2023 as a result.

The Insider Warrants were issued to directors following their participation in a Company financing in July 2020.

The Insider Warrants are held by Paul Johnson, former Director and Chief Executive Officer of the Company and Ed Shaw, Non-executive Director (together the “Insiders”) as follows:

|

Warrant Holder |

Number of Warrants |

Exercise Price |

|

Paul Johnson |

20,000,000 |

0.75p |

|

Ed Shaw |

7,500,000 |

0.75p |

Current Status of the Insider Warrants

The Insider Warrants remain valid as the Insiders remain unable to exercise at this time due to ongoing proactive exploration and corporate activities, reflecting Ed Shaw’s director position and Paul Johnson’s continuing support to the Company as outlined in the announcement of 10 March 2023.

This exploration and corporate activity includes, but is not limited to:

– Exploration results expected to be released from the Molopo Farms Complex Project and Tati Project in Botswana and the Berringa Project in the Victoria Goldfields, Australia, and

– Developments in respect of the Company’s Athabasca uranium interests in Saskatchewan, Canada.

– Advanced spin-out IPOs and disposal activities across multiple project interests.

Under the July 2020 Warrant instrument Clause 2.3 provides that should any July 2020 Warrant holder be in the possession of price sensitive information and be thereby precluded from exercising warrant subscription rights, the exercise period shall be extended until 20 business days following the date on which the Warrant holder ceases to be an insider.

It is the Insiders’ intention to exercise the warrants as soon as they are free to do so however given the level of activity within the Company this may not be possible for some time.

The Insider Warrants remain available to exercise under Clause 2.3 however the Company has extended the expiry date on the warrants to 21 October 2023 to reflect the limitations on exercise as described above. Should the Insider Warrants be unexercised on 21 October 2023, the Insiders must either give an irrevocable commitment to exercise the Insider Warrants when next able to so do, or the Board may consider a further extension.

Related Party Note

The extension of the Insider Warrants held by Paul Johnson and Ed Shaw as outlined above, have been treated as related party transactions for the purposes of AIM Rule 13.

Sean Wade, Scott Richardson Brown and Owain Morton being the independent Directors for the purposes of the extension of the expiry date of the Insider Warrants held by Paul Johnson and Ed Shaw considers, having consulted with the Company’s nominated adviser, SP Angel, that the extension of the warrant expiry date to 21 October 2023 to such related parties is fair and reasonable insofar as the Shareholders are concerned.

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“MAR”), and is disclosed in accordance with the Company’s obligations under Article 17 of MAR.

For further information please visit https://www.powermetalresources.com/ or contact:

|

Power Metal Resources plc |

|

|

Sean Wade (Chief Executive Officer) |

+44 (0) 20 3778 1396 |

|

SP Angel Corporate Finance (Nomad and Joint Broker) |

|

|

Ewan Leggat/Charlie Bouverat |

+44 (0) 20 3470 0470 |

|

SI Capital Limited (Joint Broker) |

|

|

Nick Emerson |

+44 (0) 1483 413 500 |

|

First Equity Limited (Joint Broker) |

|

|

David Cockbill/Jason Robertson |

+44 (0) 20 7330 1883 |

NOTES TO EDITORS

Power Metal Resources plc – Background

Power Metal Resources plc (LON:POW) is an AIM listed metals exploration company which finances and manages global resource projects and is seeking large scale metal discoveries.

The Company has a principal focus on opportunities offering district scale potential across a global portfolio including precious, base and strategic metal exploration in North America, Africa and Australia.

Project interests range from early-stage greenfield exploration to later-stage prospects currently subject to drill programmes.

Power Metal will develop projects internally or through strategic joint ventures until a project becomes ready for disposal through outright sale or separate listing on a recognised stock exchange thereby crystallising the value generated from our internal exploration and development work.

Value generated through disposals will be deployed internally to drive the Company’s growth or may be returned to shareholders through share buy backs, dividends or in-specie distributions of assets.

Markets and Stocks March 2023 – Doc Holliday talks to Alan Green

22nd March 2023 / Leave a comment

Markets and Stocks March 2023 – Doc Holliday talks to Alan Green. Doc and Alan discuss the Bloomberg article on former rogue trader Nick Leeson’s new role with the Red Mist Market Enforcement Unit to investigate financial misconduct. On the stocks front we discuss Versarien #VRS and how innovative companies need to raise money. We discuss ECR Minerals #ECR and Longboat Energy #LBE and briefly look at First Class Metals #FCM and Power Metal Resources #POW

Power Metal Resources #POW – New CEO Sean Wade talks to Alan Green

10th March 2023 / Leave a comment

Power Metal Resources #POW – New CEO Sean Wade talks to Alan Green about current projects, including the Molopo Farms project and the Tati project in Botswana, plus upcoming IPOs for Golden Metal Resources, First Development Resources, Uranium Energy Exploration and New Ballarat Gold Corp. Sean discusses the challenging environment for the share price, how the team remain focussed on delivering on their objectives regardless and how he believes in the great inherent value in the business.

#POW Power Metal – Total Voting Rights

31st January 2023 / Leave a comment

Power Metal Resources plc (“Power Metal” or the “Company”)

Total Voting Rights

In accordance with the Financial Conduct Authority’s Disclosure and Transparency Rules, the Company hereby announces that as at 31 January 2023 there were 1,727,574,806 ordinary shares of 0.1 pence each in issue, none of which are held in treasury. Therefore, the total number of voting rights in the Company is 1,727,574,806.

The above figure of 1,727,574,806 may be used by shareholders in the Company as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change in their interest in, the share capital of the Company under the FCA’s Disclosure and Transparency Rules.

Power Metal Resources #POW – Tati Gold Project, Botswana – Exploration Plans

15th December 2022 / Leave a comment

Company in Final Stages of Planning Next Exploration Steps which will Include Soil Sampling, Geophysics, Trenching and Reverse Circulation & Diamond Drilling

Power Metal Resources PLC (LON:POW) the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces an exploration update from its 100% owned and operated Tati Gold Project (“Tati” or the “Project”) located within the Tati Greenstone Belt near Francistown, Botswana.

Paul Johnson, Chief Executive Officer of Power Metal Resources plc commented:

“ At the Tati Gold Project we are focused on discovering a large gold deposit. So far, in our view, the evidence gathered is increasingly compelling.

We have therefore accelerated next stage Project exploration plans, through which we believe we can move the Project forward quite considerably.

Those plans are outlined in further detail below and will test a much larger portion of the 8km gold-in-soil anomaly. The plans also include the first testing of gold at depth to add to the near surface mineralisation already identified.

Further announcements will follow in due course as we execute on the plans outlined below.”

KEY PROJECT FEATURES

|

Gold-in-soil anomaly identified (the “Anomaly”). |

Anomaly coincident with a major regional shear structure extending over a strike distance of approximately 8 kilometresthrough the centre of Project (Figure 1 below).

|

|

Soil sampling and reverse circulation (“RC”) drilling undertaken within the Anomaly. |

To date, shallow high-grade and bonanza grade gold (up to 47.1g/t Au) intersected within northwest and southeast segments of the Anomaly. |

|

Extensive near-surface gold mineralisation. |

Identified from the 175m strike length tested with the prospect of further mineralisation across the remainder of the 8km Anomaly. |

|

Potential for further gold mineralisation at depth. |

Maximum RC drillhole depth to date of 55m, additional drill testing expected to test for further gold mineralisation at depth. |

|

Cherished Hope, a former working gold mine, situated within the Project footprint. |

Extensive evidence of gold production from Cherished Hope, providing a focal point for initial and follow-on exploration. |

|

Local processing plant. |

Within 20km from the Project, capable of processing fines dumps and any other material mined from the Project (subject to relevant local approvals). |

DRILL RESULTS TO DATE LEAD TO EXPEDITED NEXT STAGE EXPLORATION

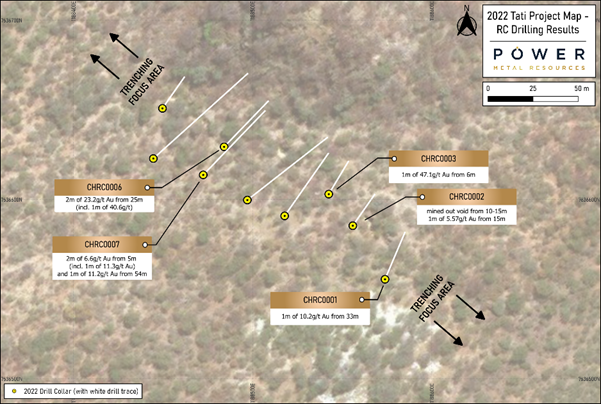

Assays results from the August 2022 reverse circulation (“RC”) drilling programme returned multiple near-surface bonanza grade intercepts including 1m of 47.1g/t gold (“Au”) from 6m downhole in drillhole CHRC0003 as well as 1m of 40.6g/t Au (from 2m of 23.2g/t Au) from 26m downhole in drillhole CHRC0006.

Due to the high-grade nature of the results achieved, the Company has fast tracked planning for the next stage of exploration, the details of which are highlighted below.

Full drill programme assays were released on 3 & 7 November 2022 and can be found at the links below:

NEXT STAGE EXPLORATION HIGHLIGHTS

The next stage planned exploration programme will include various elements which are highlighted below:

· High-resolution soil geochemistry programme focused on approximately 3km of strike-length extension from the Cherished Hope mine where a historical widely spaced soil sampling programme highlighted multiple gold-in-soil anomalies with individual results up to 2,150ppb (2.15g/t) Au-in-soil. Approximately 500-600 individual soil samples are planned with follow up assay testing of samples.

· A ground magnetometer geophysics survey focusing on the northwestern strike length extension of the Cherished Hope Mine. The goal of the magnetometer survey is to provide high-resolution imaging of any structures or geology which may have had an influence on the emplacement of mineralised quartz reef structures.

· A mechanised trenching programme focused on extending the known strike-length extension of the main quartz reef structure at Cherished Hope which has currently been intersected by drilling over a ~175m strike-length (see Figure 2 below). The quartz reef currently remains open towards the northwest and southeast as well as down dip.

Approximately 12-15 RC drillholes are planned which will be designed to test for the along strike, and down dip extension of the main mineralised quartz reef structure. Multiple holes from the 2022 programme intersected mined-out voids, including drillhole CHRC0002 which was designed to test one of the thicker portions of the quartz reef, but due to the shallow dip chosen, it intersected a mining void from 10-15m downhole. Interestingly, 1m of 5.6g/t Au was intersected from 15-16m representing the footwall of the main quartz reef structure. At least one planned hole will have a steepened dip here in order to drill test the entire section of this quartz reef.

· Following the completion of the RC drilling component, approximately 3-5 diamond drillholes are planned which will be designed to drill test select portions of the quartz reef structures which were successfully delineated by the RC drilling. Diamond drilling provides full core rock samples, and therefore valuable information about structure, geology, and the nature of gold mineralisation.

· Preparations for the above programme are currently underway and the Company will provide further information in due course as programme elements are launched, commencing in early 2023. Components of the planned exploration programme could be changed dependent on results from the various elements planned.

FURTHER INFORMATION

Figure 1 – Tati Project Overview Plan Map:

Figure 2 – Tati Project Q3 Drilling Area Zoomed Plan Map:

QUALIFIED PERSON STATEMENT

The technical information contained in this disclosure has been read and approved by Mr Nick O’Reilly (MSc, DIC, MIMMM, MAusIMM, FGS), who is a qualified geologist and acts as the Qualified Person under the AIM Rules – Note for Mining and Oil & Gas Companies. Mr O’Reilly is a Principal consultant working for Mining Analyst Consulting Ltd which has been retained by Power Metal Resources PLC to provide technical support.

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“MAR”), and is disclosed in accordance with the Company’s obligations under Article 17 of MAR.

For further information please visit https://www.powermetalresources.com/ or contact:

|

Power Metal Resources plc |

|

|

Paul Johnson (Chief Executive Officer) |

+44 (0) 7766 465 617 |

|

SP Angel Corporate Finance (Nomad and Joint Broker) |

|

|

Ewan Leggat/Charlie Bouverat |

+44 (0) 20 3470 0470 |

|

SI Capital Limited (Joint Broker) |

|

|

Nick Emerson |

+44 (0) 1483 413 500 |

|

First Equity Limited (Joint Broker) |

|

|

David Cockbill/Jason Robertson |

+44 (0) 20 7330 1883 |

NOTES TO EDITORS

Power Metal Resources plc – Background

Power Metal Resources plc (LON:POW) is an AIM listed metals exploration company which finances and manages global resource projects and is seeking large scale metal discoveries.

The Company has a principal focus on opportunities offering district scale potential across a global portfolio including precious, base and strategic metal exploration in North America, Africa and Australia.

Project interests range from early-stage greenfield exploration to later-stage prospects currently subject to drill programmes.

Power Metal will develop projects internally or through strategic joint ventures until a project becomes ready for disposal through outright sale or separate listing on a recognised stock exchange thereby crystallising the value generated from our internal exploration and development work.

Value generated through disposals will be deployed internally to drive the Company’s growth or may be returned to shareholders through share buy backs, dividends or in-specie distributions of assets.

Exploration Work Overview

Power Metal holds a number of priority exploration projects with active exploration underway currently. The status of each project is outlined in the table below:

|

Project |

Operations |

POW % |

Project Status |

|

|

Athabasca Uranium |

12 properties covering an area of 842km2 in the Athabasca Basin region Canada. |

100% |

Exploration programmes undertaken across three properties during summer 2022 and preliminary planning for work in Spring/Summer 2023 is ongoing. Desktop review work ongoing across the existing portfolio and data rooms established for all the projects, to enable third party review of opportunities for potential acquisition, joint venture or earn-in. Ongoing review of new opportunities to further expand the Company’s Athabasca uranium property exposure. |

|

|

Molopo Farms Nickel – PGMs |

3 prospecting licences covering 1,723km2 in south-west Botswana |

87.71% |

Currently a 2,600m diamond drill programme is underway with a planned 5-6 holes targeting four previously identified magnetic conductors prospective for Nickel – Platinum Group Metals. 2 drill holes at target conductor T1-6 and one at T1-14 have been completed and drilling at target T1-3 target is underway currently. Downhole geophysics completed at DDH1-6A and underway at DDH1-14B. Further Moving Loop Electro-Magnetic surveys are planned over additional Airborne Electro-Magnetic targets identified, to develop further drill targets. |

|

|

Tati Project Gold – Nickel |

Botswana |

100% |

Reverse Circulation drilling and soil sampling confirmed high-grade and bonanza grade gold mineralisation within a gold-in-soil anomaly extending for 8km across the Company’s prospecting licences. Next stage exploration plans announced 15.12.22. Sampling of fines dumps, representing waste material from the Cherished Hope gold mine on the project has confirmed circa 1g/t gold and suitability of the fines dumps for processing to extract gold and generate income. Preparations for the fines dumps processing are advancing. |

|

Exploration work programmes may also be underway within Power Metal investee companies and planned IPO vehicles where Power Metal has a material interest, the findings from which will be released on their respective websites, with simultaneous updates through Power Metal regulatory announcements where required. These interests are summarised in the table below:

|

Company |

Operations |

Status |

POW % |

Further Information Link |

|

First Class Metals PLC |

Exploration in the Schreiber-Hemlo region of Ontario, Canada |

Listed Investment |

27.91% |

|

|

Kavango Resources PLC |

Exploration in Botswana |

Listed Investment |

9.85% |

|

|

First Development Resources PLC |

Exploration in Western Australia and the Northern Territory of Australia |

Planned IPO |

62.12%* |

www.firstdevelopmentresources.com

|

|

Golden Metal Resources PLC |

Exploration and development in Nevada, USA |

Planned IPO |

83.13% |

|

|

New Ballarat Gold PLC |

Exploration in the Victoria Goldfields of Australia |

Planned IPO |

49.9% |

New website under development which can be found atwww.newballaratgoldcorp.com . In the interim further information in respect of NBGC can be found at: https://www.powermetalresources.com/project/victoria-goldfields/ . |

|

NewCo |

Exploration in Queensland’s Mount Isa copper belt and in South Australia |

Planned IPO/Disposal |

20% ^ |

NewCo website under development. |

|

Uranium Energy Exploration PLC |

Uranium exploration in the Athabasca region of Canada |

Planned IPO |

50-55%~ |

* reducing to 58.59% on issue of equity for NSR buyout announced 5.12.22.

^ subject to completion of Merger announced 15.12.22.

~ subject to completion of disposal of Reitenbach and E-12 properties, announced on 8.8.22 and 4.11.22, respectively.

Power Metal Resources #POW – December interview with CEO Paul Johnson

5th December 2022 / Leave a comment

Alan Green talks to CEO Paul Johnson. We cover the drilling campaign at the Molopo Farms Complex project in Botswana, before Paul covers recent developments at the Tati Gold project, also in Botswana. We then look at developments in Canada, both at the group’s Athabasca Uranium project and the new Lithium project acquisition, before we turn to the upcoming IPO’s including Golden Metal Resources and First Development Resources. Paul looks at what the Christmas period will hold for the POW team and the likely news flow over the Xmas period and into the new year.

Power Metal Resources #POW – FDR Selta Lithium Exploration & Company Update

5th December 2022 / Leave a comment

Power Metal Resources PLC (LON:POW), the London listed exploration company seeking large-scale metal discoveries across its global project portfolio provides an update to shareholders in respect of lithium focussed fieldwork at the Selta Project (“Selta” or the “Project”), located in Australia’s Northern Territory. Selta is held through its subsidiary First Development Resources PLC (“First Development Resources” or “FDR”) which is seeking a planned listing in the London capital markets (Power Metal holds 62.12% of FDR and 58.59% after transaction outlined below).

Power Metal Resources PLC (LON:POW), the London listed exploration company seeking large-scale metal discoveries across its global project portfolio provides an update to shareholders in respect of lithium focussed fieldwork at the Selta Project (“Selta” or the “Project”), located in Australia’s Northern Territory. Selta is held through its subsidiary First Development Resources PLC (“First Development Resources” or “FDR”) which is seeking a planned listing in the London capital markets (Power Metal holds 62.12% of FDR and 58.59% after transaction outlined below).

HIGHLIGHTS:

Phase II Lithium Focused Exploration Programme

· Lithium focussed Phase II follow-up fieldwork now underway to further examine the zonation of a prospective pegmatite system present at FDR’s 100% owned Selta Project. Pegmatites are the target lithology which have the potential to host lithium mineralisation.

· Approximately 700 potential outcropping pegmatites have been identified by desktop analysis, within a target area of circa 180km2 (see Fig.1 below). Given the size of the prospective area and the number of targets generated, the planned fieldwork will initially focus on a 30km2 area in the southeast of the Project (see Figure 1).

· The Phase II fieldwork follows on from the successful findings of the Phase I field reconnaissance programme in June 2022, which confirmed the presence of pegmatite geology over a small area within the south of the Project, with lithogeochemical analysis of 17 samples suggesting potential for a zoned pegmatite system originating from the nearby granites 1.

· A desktop analysis of lithium specific publicly available datasets, satellite imagery and purpose commissioned hyperspectral analysis previously outlined the presence of potentially pervasive outcropping pegmatites 2, 3 which are the subject of the current fieldwork campaign.

· Further information in respect of the lithium work programme is provided below.

Company Update

· FDR continues to advance preparations for its planned listing and is very close to completion of all material work streams.

· To further enhance FDR’s position in advance of the planned listing and in light of the positive progress across the exploration programmes at all projects, the net smelter return (“NSR”) royalties retained by the original vendors of FDR’s projects have been purchased by FDR.

· The two NSRs were originally announced on the acquisition of First Development Resources Pty Limited (“FDR Australia”)(RNS: 29.10.2021 4) and URE Metals Pty Ltd (“URE Metals”)(RNS: 19.11.2021 5) and were each a 2% NSR, with a 1% buyout right for A$1,000,000. The NSRs were held by the original shareholders of FDR Australia and URE Metals whose shareholdings were previously acquired, as outlined in the above dated announcements.

· Each NSR has been purchased for £150,000, payable through the issue of 1,875,000 new FDR ordinary shares of 1.0p (“New FDR Shares”) at an issue price of 8p per share, for a total consideration of £300,000 through the issue of 3,750,000 New FDR Shares. The price of 8p per New FDR Share is specific to this NSR purchase transaction only and should not be taken as established pricing in relation to an IPO financing for the planned listing of FDR in the London capital markets.

· As a result, FDR holds a 100% interest in all projects and there are now no NSRs over any of its properties.

· Following the issue of the New FDR Shares, the total FDR issued share capital will amount to 65,894,076 shares of which Power Metal holds 38,605,697 shares representing 58.59% of FDR issued share capital.

Tristan Pottas, Chief Executive Officer of First Development Resources commented:

“Much of the recent focus has been on preparing for FDR’s planned UK listing, however, the team has also remained committed to advancing the project portfolio for the ongoing benefit of FDR shareholders.

Over the past several months the FDR team has worked hard to develop strong relationships with the key stakeholders at Selta to facilitate the efficient deployment of field teams to site to complete value enhancing work.

The technical analysis of the outcropping pegmatites will significantly improve our understanding of the system present at Selta and will help inform future work programmes with the intention of identifying zones within the Project with the potential to host lithium mineralisation.”

Paul Johnson, Chief Executive Officer of Power Metal Resources commented:

“The search for economic deposits of lithium continues to be the focus of many exploration companies globally as they look to capitalise on the strong market conditions which continue to reflect the lack of supply for the ever-growing demand for battery metals including lithium.

Importantly, with our readiness for diamond drilling at Wallal and the ongoing work programme at Selta, we are seeking to ensure FDR is a vibrant exploration business when listed.

The buyout of all project royalties by FDR was an important step, simplifying the structure of the planned listing interests and reflecting the value of FDR’s project portfolio which has been significantly enhanced since their original acquisition.”

Figure 1 : Selta Project showing lithium pegmatite and rare earth element prospective areas of interest and target area for current Phase II pegmatite focussed fieldwork

BACKGROUND – SELTA PROJECT LITHIUM REVIEW

The in-depth review of all publicly available geological, geophysical and geochemical data for the Selta Project identified multiple uranium and rare-earth element (“REE”) targets within the Selta Project area and highlighted the potential for lithium, gold and base-metal mineralisation. The potential for lithium presented an additional opportunity for a mineral discovery within the Selta Project area, an opportunity which had previously been unknown. To gain a better understanding of the potential for lithium-caesium-tantalum (“LCT”) type pegmatites, the Company immediately commenced a lithium review of all publicly available data to help refine target areas for further investigation and deployed a team to Selta to confirm the presence of pegmatite geology.

The announcement in respect of this lithium review and subsequent reconnaissance may be viewed through the following link:

During the reconnaissance the site team was able to confirm the presence of pegmatite geology and collect samples to determine mineralogy.

The results of the sampling and subsequent geochemical testing of pegmatites on the property indicated that the pegmatites analysed on the southwest of the property are part of zoned pegmatite system, most likely originating from the nearby granite. The initial sampling campaign programme covered only a very small portion of the property but provided valuable information for future exploration programmes.

SELTA PEGMATITE SAMPLING PROGRAMME

The mineral deposit model for LCT pegmatites is well defined by the United States Geological Survey and suggests LCT pegmatites tend to show a regional mineralogical and geochemical zoning pattern with respect to the inferred parental granite, with the greatest enrichment in the more distal pegmatites. FDR’s initial analysis of data acquired during the Selta lithium review supports this model.

FDR now plans to expand on this initial interpretation and conduct further exploration over a broader area. Using the data acquired from previous desktop analysis and reconnaissance, a field team led by FDR’s exploration manager will conduct a targeted pegmatite mapping and sampling programme to acquire representative geochemical and geological data in the south of the Selta Project, where previous work has proven the presence of a pegmatite system.

This work aims to constrain the zonation believed to be present in the pegmatite system. The field work will include the systematic mapping of the surface expression of pegmatites along with the collection of representative rock chip samples, which will then be sent for geochemical analysis. This field work will feed into FDR’s technical understanding of pegmatites at Selta, to provide targets and inform future work programmes.

QUALIFIED PERSON STATEMENT

The technical information contained in this disclosure has been read and approved by Mr Nick O’Reilly (MSc, DIC, MIMMM, MAusIMM, FGS), who is a qualified geologist and acts as the Qualified Person under the AIM Rules – Note for Mining and Oil & Gas Companies. Mr O’Reilly is a Principal consultant working for Mining Analyst Consulting Ltd which has been retained by Power Metal Resources PLC to provide technical support.

REFERENCE NOTES

1 Company announcement, First Development Resources – Company Update, 29 July 2022

( https://www.londonstockexchange.com/news-article/POW/first-development-resources-company-update/15562865 )

2 Company announcement, First Development Resources – Selta Lithium Update, 13 June 2022

( https://www.londonstockexchange.com/news-article/POW/first-development-resources-selta-lithium-update/15491241 )

3 Company announcement, Selta Project – Multiple Target Areas Identified, 16 March 2022

( https://www.londonstockexchange.com/news-article/POW/selta-project-multiple-target-areas-identified/15371081 )

4 Company announcement, Power Metal Acquires 100% of FDR Australia, 29 October 2021

( https://polaris.brighterir.com/public/power_metal_resources/news/rns/story/w04g16x )

5 Company announcement, Acquisition of Uranium & Rare-Earth Element Project – Australia, 19 November 2021

( https://polaris.brighterir.com/public/power_metal_resources/news/rns/story/w1ye76w )

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“MAR”), and is disclosed in accordance with the Company’s obligations under Article 17 of MAR.

For further information please visit https://www.powermetalresources.com/ or contact:

|

Power Metal Resources plc |

|

|

Paul Johnson (Chief Executive Officer) |

+44 (0) 7766 465 617 |

|

SP Angel Corporate Finance (Nomad and Joint Broker) |

|

|

Ewan Leggat/Charlie Bouverat |

+44 (0) 20 3470 0470 |

|

SI Capital Limited (Joint Broker) |

|

|

Nick Emerson |

+44 (0) 1483 413 500 |

|

First Equity Limited (Joint Broker) |

|

|

David Cockbill/Jason Robertson |

+44 (0) 20 7330 1883 |

NOTES TO EDITORS

Power Metal Resources plc – Background

Power Metal Resources plc (LON:POW) is an AIM listed metals exploration company which finances and manages global resource projects and is seeking large scale metal discoveries.

The Company has a principal focus on opportunities offering district scale potential across a global portfolio including precious, base and strategic metal exploration in North America, Africa and Australia.

Project interests range from early-stage greenfield exploration to later-stage prospects currently subject to drill programmes.

Power Metal will develop projects internally or through strategic joint ventures until a project becomes ready for disposal through outright sale or separate listing on a recognised stock exchange thereby crystallising the value generated from our internal exploration and development work.

Value generated through disposals will be deployed internally to drive the Company’s growth or may be returned to shareholders through share buy backs, dividends or in-specie distributions of assets.

Exploration Work Overview

Power Metal has multiple internal exploration programmes completed or underway, with results awaited. The status for each of the Company’s priority exploration projects is outlined in the table below.

|

Project |

Location |

Current POW % |

Work Completed or Underway |

Results Awaited |

|

Athabasca Uranium |

Canada |

100% |

Preliminary planning for work in Spring/Summer 2023 is ongoing. |

Work programmes for Spring/Summer 2023. |

|

Molopo Farms |

Botswana |

87.71% |

Diamond drill programme underway. MLEM surveys planned over additional AEM targets identified. |

Drill programme updates and findings from further MLEM survey work. |

|

Tati Project |

Botswana |

100% |

RC drilling and sampling of mine dumps complete. |

Mine dumps processing and project commercial and exploration next steps. |

Exploration work programmes may also be underway within Power Metal investee companies and planned IPO vehicles where Power Metal has a material interest, the findings from which will be released on their respective websites, with simultaneous updates through Power Metal regulatory announcements where required. These interests are summarised in the table below:

|

Company |

Status/Operations |

Link |

|

First Class Metals PLC |

Investment – POW 27.91% Exploration in the Schreiber-Hemlo region of Ontario, Canada |

|

|

Kavango Resources PLC |

Investment – POW 9.85% Exploration in Botswana |

|

|

First Development Resources PLC |

Planned IPO – POW 62.12%* (58.59% post NSR buyout) Exploration in Western Australia and the Northern Territory of Australia |

www.firstdevelopmentresources.com

|

|

Golden Metal Resources PLC |

Planned IPO – POW 83.13% Exploration and development in Nevada, USA |

|

|

New Ballarat Gold PLC |

Planned IPO – POW 49.9% Exploration in the Victoria Goldfields of Australia |

A new website is currently in development which will be found atwww.newballaratgoldcorp.com . In the interim further information in respect of NBGC can be found at: https://www.powermetalresources.com/project/victoria-goldfields/ .

|

|

Uranium Energy Exploration PLC |

Planned IPO – POW on listing estimated 50-55% Uranium exploration in the Athabasca region of Canada |

Power Metals Resources #POW – Kalahari Key Acquisition Complete – Power Metal Now Holds 87.71% Interest. Molopo Farms Drilling Update

18th November 2022 / Leave a comment

Power Metal Resources PLC (LON:POW), the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces the completion of the transaction to increase the Company’s interest in Kalahari Key Mineral Exploration Pty Limited (“KKME” or “Kalahari Key”) further details of which were provided in the Company’s announcement of 3 November 2022 (the “Transaction”):

Power Metal Resources PLC (LON:POW), the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces the completion of the transaction to increase the Company’s interest in Kalahari Key Mineral Exploration Pty Limited (“KKME” or “Kalahari Key”) further details of which were provided in the Company’s announcement of 3 November 2022 (the “Transaction”):

Kalahari Key holds a 100% interest in the Molopo Farms Complex Project (the “Project”, “Molopo Farms”), where a large-scale nickel platinum-group metal (“PGM”) discovery is being targeted in southwestern Botswana.

HIGHLIGHTS:

§ Following completion of the Transaction, Power Metal now holds 87.71% of Kalahari Key and therefore the Molopo Farms Project.

§ The 2,600m diamond drill programme at Molopo Farms is progressing well with two holes now completed at target area T1-6, and the third drill hole in progress at target area T1-14.

§ At T1-14 the Company is testing an electromagnetic superconductor identified by a recently completed moving loop electromagnetic (MLEM) survey. The last reported depth from the drillhole in progress, DDH1-14B, was 345 metres.

§ Downhole geophysics is now complete on drill hole DDH1-6B from Target area T1-6, with the geophysics interpretation results expected shortly.

Paul Johnson, Chief Executive Officer of Power Metal Resources commented:

“Today’s confirmation that Power Metal has now completed the transaction and increased its interest in Molopo Farms to 87.71% is great news for the Company. My thanks to all involved in enabling this Transaction to happen so efficiently.

We have completed the Transaction whilst in the midst of the Molopo Farms drill programme where we are progressing well with the third drill hole targeting the superconductor at target area T1-14.

A further exploration update is expected to follow in the near term as we continue, what for Power Metal, is a particularly exciting drill programme.”

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“MAR”), and is disclosed in accordance with the Company’s obligations under Article 17 of MAR.

For further information please visit https://www.powermetalresources.com/ or contact:

|

Power Metal Resources plc |

|

|

Paul Johnson (Chief Executive Officer) |

+44 (0) 7766 465 617 |

|

SP Angel Corporate Finance (Nomad and Joint Broker) |

|

|

Ewan Leggat/Charlie Bouverat |

+44 (0) 20 3470 0470 |

|

SI Capital Limited (Joint Broker) |

|

|

Nick Emerson |

+44 (0) 1483 413 500 |

|

First Equity Limited (Joint Broker) |

|

|

David Cockbill/Jason Robertson |

+44 (0) 20 7330 1883 |

NOTES TO EDITORS

Power Metal Resources plc – Background

Power Metal Resources plc (LON:POW) is an AIM listed metals exploration company which finances and manages global resource projects and is seeking large scale metal discoveries.

The Company has a principal focus on opportunities offering district scale potential across a global portfolio including precious, base and strategic metal exploration in North America, Africa and Australia.

Project interests range from early-stage greenfield exploration to later-stage prospects currently subject to drill programmes.

Power Metal will develop projects internally or through strategic joint ventures until a project becomes ready for disposal through outright sale or separate listing on a recognised stock exchange thereby crystallising the value generated from our internal exploration and development work.

Value generated through disposals will be deployed internally to drive the Company’s growth or may be returned to shareholders through share buy backs, dividends or in-specie distributions of assets.

Exploration Work Overview

Power Metal has multiple internal exploration programmes completed or underway, with results awaited. The status for each of the Company’s priority exploration projects is outlined in the table below.

|

Project |

Location |

Current POW % |

Work Completed or Underway |

Results Awaited |

|

Athabasca Uranium |

Canada |

100% |

Ground exploration programme complete at 3 properties. Preliminary planning for work in Spring/Summer 2023 is ongoing. |

Assay results from samples collected during fieldwork. |

|

Molopo Farms |

Botswana |

87.71% |

First 2 holes at T1-6 conductor target drilling complete. T1-14 first hole underway. Further MLEM surveys planned over additional AEM targets identified. |

Drill programme updates and findings from further MLEM survey work. |

|

Tati Project |

Botswana |

100% |

RC drilling and sampling of mine dumps complete. |

Mine dumps processing and project commercial and exploration next steps. |

Exploration work programmes may also be underway within Power Metal investee companies and planned IPO vehicles where Power Metal has a material interest, the findings from which will be released on their respective websites, with simultaneous updates through Power Metal regulatory announcements where required. These interests are summarised in the table below:

|

Company |

Status/Operations |

Link |

|

First Class Metals PLC |

Investment – POW 27.91% Exploration in the Schreiber-Hemlo region of Ontario, Canada |

|

|

First Development Resources PLC |

Planned IPO – POW 62.12% Exploration in Western Australia and the Northern Territory of Australia |

www.firstdevelopmentresources.com

|

|

Golden Metal Resources PLC |

Planned IPO – POW 83.13% Exploration and development in Nevada, USA |

|

|

Kavango Resources PLC |

Investment – POW 14.03% (subject to completion of Kanye Resources disposal announced 8.7.22 and issue of Kavango shares e.g. financing announced 24.10.22) Exploration in Botswana |

|

|

New Ballarat Gold PLC |

Planned IPO – POW 49.9% Exploration in the Victoria Goldfields of Australia |

A new website is currently in development which will be found atwww.newballaratgoldcorp.com . In the interim further information in respect of NBGC can be found at: https://www.powermetalresources.com/project/victoria-goldfields/ .

|

|

Uranium Energy Exploration PLC |

Planned IPO – POW on listing estimated 50-55% Uranium exploration in the Athabasca region of Canada |

Power Metal Resources #POW November Interview – Alan Green talks to CEO Paul Johnson

8th November 2022 / Leave a comment

Alan Green talks to CEO Paul Johnson. We cover the drilling campaign at the Molopo Farms Complex project in Botswana, where nickel sulphides have been identified, before Paul covers the bonanza gold grades announced this week at the Tati Gold project, also in Botswana. We then look at developments at the group’s uranium assets, including the development of Uranium Energy Exploration, before with turn to the upcoming IPO freight train, including Golden Metal Resources, First Development Resources and the New Ballarat Gold Company. Paul looks at what the IPO’s will mean for the POW balance sheet, before covering some of the other key upcoming value inflection points.

Power Metal Resources #POW – Molopo Farms Complex – Geophysics Update T1-14

25th October 2022 / Leave a comment

Power Metal Resources PLC (LON:POW), the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces an update in relation to the Molopo Farms Complex Project (“Molopo Farms” or the “Project”) targeting a large-scale nickel-copper-platinum group element (“PGE”) discovery in southwestern Botswana where drilling is currently underway.

Power Metal Resources PLC (LON:POW), the London listed exploration company seeking large-scale metal discoveries across its global project portfolio announces an update in relation to the Molopo Farms Complex Project (“Molopo Farms” or the “Project”) targeting a large-scale nickel-copper-platinum group element (“PGE”) discovery in southwestern Botswana where drilling is currently underway.

On 20 October 2022 the Company announced an update regarding the ongoing drilling programme and the link to this announcement is below:

Further detailed work in regard to the moving loop electromagnetic (“MLEM”) survey results over the target area T1-14 has been ongoing, with an update relating to those results presented herein.

HIGHLIGHTS

§ A geophysical electromagnetic (“EM”) ‘superconductor’ has now been identified at target area T1-14, with a conductance reading akin to that of massive sulphides. 1

§ As a result, the superconductor at target area T1-14 has been upgraded to priority status and will be subject to diamond drilling in the coming weeks, being now the strongest MLEM conductor identified on the Project to date.

§ Diamond drilling at target area T1-14 will commence after the completion of diamond drillholes DDH1-6B and DDH1-6B(2), both targeting the conductor identified within target area T1-6.

Paul Johnson, Chief Executive Officer of Power Metal Resources PLC commented:

“The momentum at our Molopo Farms Complex Project continues to build and we now have four Company designated priority (A+) targets that we plan to test during the ongoing drilling campaign.

The results from the extra MLEM work over target area T1-14 are quite definitive and have resulted in the upgrade of this target area following the identification of a superconductor.

I appreciate that the mineral discoveries under cover that we seek at Molopo Farms, and at other Company interests, often require a long lead time with complex preparatory work often needed to define drill targets. However, we have the rig drilling now at Molopo Farms and the drill testing of the T1-14 superconductor, targeting a massive nickel sulphide discovery, is expected to commence in the coming weeks.”

FURTHER INFORMATION

Target Area T1-14

§ During the 2020/2021 drilling campaign, a 515.8m long diamond drillhole (KKME1-14) was drilled within target area T1-14 which was targeting a priority airborne EM conductor.

§ Drillhole KKME1-14 intersected three main geological units including serpentinites (40.4m – 208.5m) quartzites (208.5 – 479.6m) and graphitic mudstones (479.6 – 515.8m). It was originally assumed that the graphitic mudstone was the cause of the airborne conductive anomaly identified at this target zone – and as a result the hole was shut down at 515.8m.

§ The conductor at target area T1-14 was originally given a lower priority B ranking due to it being slightly deeper than priority conductors found at T1-6, T2-3 and T1-3. However, following further analysis of available datasets, the following conclusions have been reached:

o The MLEM conductor modelled at target area T1-14 has been classified as a superconductor, ranking it as the strongest conductor identified at the Project to date. The conductance reading at T1-14 is akin to that of massive sulphides.

o KKME1-14 was drilled mostly within a magnetic low, which is consistent with the drillhole intersecting mostly sedimentary rock units instead of targeted mafic/ultramafic rocks (which are typically strongly magnetic and can host primary magmatic nickel sulphides).

o The MLEM superconductor now modelled at target area T1-14 has a discrete shape. If the graphitic mudstones were the cause of the conductor identified at this target area, it would be expected that this conductor would be flat-lying, consistent with the typically very flat-lying and continuous nature of Transvaal sedimentary units within the Molopo Farms Complex.

o Three dimensional (“3D”) modelling of KKME1-14 shows that it intersected only the edge of the newly identified superconductor.

§ The combination of the ground MLEM and airborne EM geophysics datasets into a single 3D model has enabled a geological model to be developed. This is interpreted to show a geological contact zone between mafic/ultramafic magmatic intrusive rocks and potentially sulphur rich sedimentary rocks (as signified by overlapping highly magnetic and conductive bodies). Melting of the sedimentary rocks at this intrusive contact zone could have led to magma mixing, differentiation, and contamination that triggered sulphide saturation and the segregation of an immiscible sulphide melt which could have resulted in the accumulation of massive sulphide mineralisation. It appears that this prospective, highly conductive, contact zone was not intersected by the previous drillhole KKME1-14.

§ As a result of further integration and analysis of available datasets, target area T1-14 has been upgraded by the Company to Priority A+ status and a 700m drillhole (DDH1-14A) is now planned following the completion of DDH1-6B(2). It is estimated that the superconductor could be reached at a downhole depth between 450-500m.

FURTHER INFORMATION

Figure 1 – Molopo Farms Complex Project Plan Map: A plan map of the Project area, including the location of various elements mentioned above is outlined in Figure 1 below.

Figure 2 – T1-14 3D View (Magnetics; Pink = Magnetic High): A 3D view showing the location of the planned drillhole DDH1-14A and historical drillhole KKME1-14 with the ground magnetic inversion. KKME1-14 was drilled mostly within a magnetic low, which is consistent with the quartzites and carbonaceous mudstones.

Figure 3 – T1-14 3D View (MLEM: Blue = Conductivity High): A 3D view showing the location of the planned drillhole DDH1-14A and historical drillhole KKME1-14 with the MLEM superconductor identified.

The diagrams and images presented above will be uploaded shortly to the Company’s website which may be reached through the following link:

https://www.powermetalresources.com/project/molopo-farms-complex/

Further photographs and videos from the drill programme are and will be available on the Company’s website gallery section, through the following link:

https://www.powermetalresources.com/investors/gallery/molopo-farms-complex-botswana/

PROJECT BACKGROUND AND OWNERSHIP

Power Metal currently has a current circa 53% effective economic interest in Molopo, held through a direct project interest and a shareholding in partner Kalahari Key Mineral Exploration (Pty) Ltd (“KKME”). On 18 May 2022 Power Metal announced a conditional transaction that would see its interest in Molopo Farms increasing to 87.71% (the “Transaction”). The announcement may be viewed through the following link:

https://www.londonstockexchange.com/news-article/POW/kalahari-key-botswana-acquisition/15458701

As part of the Transaction, Power Metal will become the Project operator and in advance of completion the Company is working with the team at KKME to maintain momentum with regard to Project exploration.

Work streams are also in process to secure Botswana regulatory approvals enabling the Transaction to complete.

Reference Notes

1 The term ‘superconductor’ is utilised here, to describe a region of very high geophysical conductivity as depicted by a very slow decay of the electromagnetic signal. In the case of T1-14, the electromagnetic signal has not decayed to system noise levels after 2,000 milliseconds (msecs). The calculated decay constant is between 400 and 550 msecs which is common for massive nickel sulphides.

Glossary

Serpentinite: Mafic rock composed of one or more serpentine group minerals. Serpentinization is a form of low-temperature metamorphism of ultramafic rocks. They often are strongly magnetic.

Quartzite: Hard, non-foliated metamorphic rock which was originally very quartz rich. It has a low magnetic and conductance response.

Graphitic Mudstone: Graphite rich, fine-grained clastic sedimentary rock. It has a low magnetic and can have a high conductance response.

QUALIFIED PERSON STATEMENT

The technical information contained in this disclosure has been read and approved by Mr Nick O’Reilly (MSc, DIC, MIMMM, MAusIMM, FGS), who is a qualified geologist and acts as the Qualified Person under the AIM Rules – Note for Mining and Oil & Gas Companies. Mr O’Reilly is a Principal consultant working for Mining Analyst Consulting Ltd which has been retained by Power Metal Resources PLC to provide technical support.

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“MAR”), and is disclosed in accordance with the Company’s obligations under Article 17 of MAR.

For further information please visit https://www.powermetalresources.com/ or contact:

|

Power Metal Resources plc |

|

|

Paul Johnson (Chief Executive Officer) |

+44 (0) 7766 465 617 |

|

SP Angel Corporate Finance (Nomad and Joint Broker) |

|

|

Ewan Leggat/Charlie Bouverat |

+44 (0) 20 3470 0470 |

|

SI Capital Limited (Joint Broker) |

|

|

Nick Emerson |

+44 (0) 1483 413 500 |

|

First Equity Limited (Joint Broker) |

|

|

David Cockbill/Jason Robertson |

+44 (0) 20 7330 1883 |

NOTES TO EDITORS

Power Metal Resources plc – Background

Power Metal Resources plc (LON:POW) is an AIM listed metals exploration company which finances and manages global resource projects and is seeking large scale metal discoveries.

The Company has a principal focus on opportunities offering district scale potential across a global portfolio including precious, base and strategic metal exploration in North America, Africa and Australia.

Project interests range from early-stage greenfield exploration to later-stage prospects currently subject to drill programmes.

Power Metal will develop projects internally or through strategic joint ventures until a project becomes ready for disposal through outright sale or separate listing on a recognised stock exchange thereby crystallising the value generated from our internal exploration and development work.

Value generated through disposals will be deployed internally to drive the Company’s growth or may be returned to shareholders through share buy backs, dividends or in-specie distributions of assets.