Home » Posts tagged 'daniel ozon'

Tag Archives: daniel ozon

New Mine in the Lublin province. Will it be built by JSW?

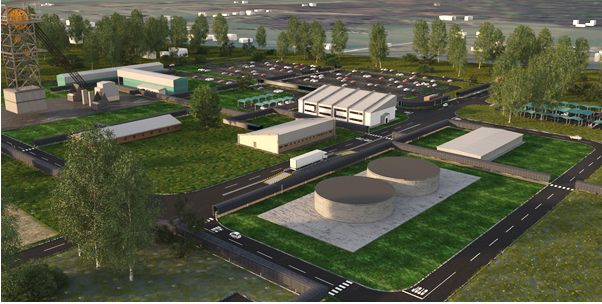

Jastrzębska Spółka Węglowa is interested in Lublin coal. The Silesians are negotiating with the Australian company Prairie Mining Limited the conditions for taking over the rights to the fields located between Siedliszcze and Cyców. It is in this region, specifically in the village of Kulik, that the mine Jan Karski would be created.

– The Polish government is very interested in the creation of the mine in Chełmszczyzna. This is one of the tasks that I supported from the beginning, also supported by the Prime Minister and Minister of Energy Krzysztof Tchórzewski. That is why we organized a meeting with the president of JSW, who will present plans for the Lublin Basin – said Beata Mazurek, deputy speaker of the Sejm during the Friday conference in Chełm.

Daniel Ozon, CEO of JSW, also took part in the meeting in the Chełm Delegation of the Provincial Office. He confirmed interest in coking coal deposits in the Lublin Coal Basin. The technical dialogue on the possible takeover of deposits, JSW and Prairie have been running for six months. – Chełmszczyzna has large reserves of coking coal, which would allow us to increase extraction and reduce production costs. The deposits that interest us are located in the central and south-eastern part of the Lublin province. There are 200 million tons of coal in the area of 151 sq m. The cost of building a mine is estimated at approx. PLN 2.5 billion – Daniel Ozon explained. Prime Minister Mateusz Morawiecki also spoke about the construction of the mine during his short visit to Chełm.

JSW European tycoon

JSW is currently the largest producer of coking coal in Europe. The company estimates that it will extract approx. 5 million tonnes of gas per year. About 2,300 people would find employment in the mine. In the case of works related to the investment and subsequent mining and transport, the number of jobs could increase fivefold.

– After finalising the negotiations, JSW decided that Chełmszczyzna, in which the Jan Karski mine will be established, will be the headquarters of the JSW Wschód Company. We also intend to submit preliminary documents to the Ministry of the Environment in the coming days to apply for the right to geological information about the Pawłów fields, which are located south of the Jan Karski area – declared Daniel Ozon.

As JSW explains, its plans will not affect the operations of “Bogdanka” located in the area of Lubelski Węgiel, which extracts steam coal used in power plants. – There will be no conflict of interest because a different kind of raw material is extracted in “Bogdanka”. I even think that if our project is finalised, we can think about broadly understood cooperation – says JSW president.

The authorities of Prairie and its Polish daughter company PD Co confirm that advanced negotiations are underway with JSW regarding the mine. However, they do not want to reveal details. – Further information will be provided in the form of stock market announcements, in accordance with the regulations – said Ben Stoikovich, president of PD Co.

He has been talking about plans to build a new Prairie mine since at least 2012. In October last year, the company filed with the Regional Directorate for Environmental Protection a request for environmental decision and other documents. Since then, they have been evaluated by RDOŚ.

Reuters – Poland’s JSW seeks ministry approval to buy Prairie Mining #PDZ assets

KATOWICE, Poland (Reuters) – Poland’s state-run JSW (JSW.WA) is awaiting approval from the Energy Ministry in its bid to acquire the Polish mining assets of Australia’s Prairie Mining (PDZ.AX), JSW said on Wednesday.

KATOWICE, Poland (Reuters) – Poland’s state-run JSW (JSW.WA) is awaiting approval from the Energy Ministry in its bid to acquire the Polish mining assets of Australia’s Prairie Mining (PDZ.AX), JSW said on Wednesday.

Prairie Mining has been developing coking coal projects at the Jan Karski mine in southeast Poland and the Debiensko mine in Silesia, Poland’s industrial heartland in the south. JSW has said it wants to increase its coking coal output.

“We maintain that we would like to take over Prairie Mining assets, however we still need to obtain the owner’s approvals, which means that the Energy Ministry opinion is necessary,” JSW Chief Executive Daniel Ozon told Reuters.

“This is why it is unlikely that the whole process of assessing Prairie Mining assets will finish in September,” he said, adding he hoped the process would be completed in October.

“This is why it is unlikely that the whole process of assessing Prairie Mining assets will finish in September,” he said, adding he hoped the process would be completed in October.

He did not give a value for any transaction. Prairie Mining has a market capitalization of A$79 million ($57 million).

Sources told Reuters this month that JSW, which has been in talks on cooperation with the Australian firm for much of this year, wanted a controlling stake in Prairie Mining to tighten its grip as the EU’s biggest coking coal miner.Ozon declined to comment on that issue.

The Energy Ministry, which supervises the mining industry, had planned to dismiss Ozon last week after disagreements over strategy but a meeting of the supervisory board in which this was expected to take place was canceled last week, sources said. JSW declined to comment on the meeting.

Ozon also declined to comment on the matter.

Energy Minister Krzysztof Tchorzewski told Reuters last week that he was familiar with JSW’s plan to take over Prairie Mining but declined to provide details.

Link here to view on Reuters website

JSW coking coal works on Prairie Mining #PDZ asset valuation, further decisions likely in mid-Sept _ PAP Business

Listed coking coal miner JSW is working on the asset valuation of peer Prairie Mining #PDZ and expects to announce its further decisions on the subject in mid-September, CEO Daniel Ozon told reporters.

Listed coking coal miner JSW is working on the asset valuation of peer Prairie Mining #PDZ and expects to announce its further decisions on the subject in mid-September, CEO Daniel Ozon told reporters.

“The legal audits are being finalized and, together with advisors, we are working on asset valuation,” Ozon said, adding that the completed technical audits of the projects Debiensko and Jan Karski showed that both these projects meet JSW’s expectations as to the quality of coal.

“We will be informing of further steps likely in mid-September,” Ozon also said.

In July Ozon said JSW expected to make a decision on possible cooperation with Prairie Mining or purchase of Prairie assets by the end of August.

In early June Ozon told PAP JSW is in talks with Prairie Mining regarding potential investment in Prairie assets. JSW’s options include taking over Prairie Mining as a whole, or particular assets, because mining licenses belong to subsidiaries, not the firm itself, he said at the time.

Original article here

JSW: A decision soon on Prairie Mining’s #PDZ assets

JSW assumes that by the end of July it will decide on the assets of Prairie Mining – informed the president Daniel Ozon. “I assume that by the end of July we will be after full analysis and technical reports and reports from legal and financial advisors and at the end of July we will probably make such a decision “– said the president of JSW.

JSW assumes that by the end of July it will decide on the assets of Prairie Mining – informed the president Daniel Ozon. “I assume that by the end of July we will be after full analysis and technical reports and reports from legal and financial advisors and at the end of July we will probably make such a decision “– said the president of JSW.

At the end of March, JSW reported on the conclusion of an agreement with Prairie Mining on the potential establishment of cooperation on Prairie coal projects in Poland

At the end of March, JSW reported on the conclusion of an agreement with Prairie Mining on the potential establishment of cooperation on Prairie coal projects in Poland . Prairie was to provide information about the coking coal mining project in the Dębieńsko-1 concession and information about the Jan Karski project in the Lublin Coal Basin. “For several weeks, including advisors, we have audited these concessions and are investigating the state of their legal status,” Ozon said.

. Prairie was to provide information about the coking coal mining project in the Dębieńsko-1 concession and information about the Jan Karski project in the Lublin Coal Basin. “For several weeks, including advisors, we have audited these concessions and are investigating the state of their legal status,” Ozon said.

He added that it is not simple, among others due to disputes with Bogdanka’s management regarding Jan Karski. “The next stage we would possibly go through is price-related issues and price negotiations, if we find out that these assets are interesting to us,” he said. He repeated that there are various scenarios: cooperation with Prairie Mining, takeover of one or both projects or total abandonment of these concessions.

Ozon informed that, theoretically, for the Dębieńsko-1 deposit, JSW can reach from the Szczygłowice mine. The total resources of this deposit are estimated at 301 million tonnes, and the resources shown to be acquired at 93 million tonnes. The planned service life is about 50 years.

“Potentially, we could consider the scenario that in the first phase of exploitation we are able to extract coal without the need to build a shaft and infrastructure, using the Szczygłowice infrastructure, and at the same time build the shaft to start production at full steam around 2-2.5 million tonnes annually, “said Ozon.

“The Dębina concession in potentially two stages of accessibility is interesting for us, because it enables fairly rapid entry into decks and production in the first phase, without major investment outlays, to 0.5 million tonnes of coal,” added JSW.

He informed that in the case of the Jan Karski mine project, total resources are estimated at 728 million tons of coal, and resources indicated for acquisition at 352 million tons. JSW informed PAP Biznes several weeks ago that after the results for the first half of the year the company could enter the US market with the issue of bonds and ends talks with banks regarding a syndicated loan in the amount of approx. PLN 1 billion in refinancing on the domestic market.

On Friday, Ozon said the issue of bonds is being analyzed. “As for debt refinancing, in the summer we should finalize a five-year syndicated loan,” said Ozon.

Polish Press Agency

Original article here

Prairie Mining #PDZ – Update regarding discussions on possible co-operation with JSW

Further to Prairie Mining #PDZ announcement on 29 March 2018 on the possible co-operation between Prairie and Jastrzębska Spółka Węglowa SA (“JSW”), Prairie notes recent press articles regarding comments by representatives from JSW on possible transaction(s) between the Company and JSW with respect to Prairie’s Polish coal projects.

Further to Prairie Mining #PDZ announcement on 29 March 2018 on the possible co-operation between Prairie and Jastrzębska Spółka Węglowa SA (“JSW”), Prairie notes recent press articles regarding comments by representatives from JSW on possible transaction(s) between the Company and JSW with respect to Prairie’s Polish coal projects.

The Company advises that discussions continue to take place as part of the exchange of technical and commercial information as referenced in the Company’s announcement on 29 March 2018. Commercial discussions continue to be at a preliminary stage and that even if they move onto discussions of specific transactions terms there can be no certainty as to whether any transaction(s) will be agreed, or the potential form of such transaction(s). The Company expects further exchange of information will continue with JSW.

Any potential transaction(s), should they occur, may be subject to a number of conditions including, but not limited to, obtaining positive evaluations and expert opinions, necessary corporate approvals, consents and approvals related to funding, consents from Poland’s Office of Competition and Consumer Protection (UOKiK) if required, and any other requirements that may relate to the strategy, objectives and regulatory regimes applicable to the respective issuers.

The Company will continue to comply with its continuous disclosure obligations and will make announcements to the market as required.

For further information, please contact:

|

Prairie Mining Limited |

Tel: +44 207 478 3900 |

|

Ben Stoikovich, Chief Executive Officer |

Email: info@pdz.com.au |

|

Sapan Ghai, Head of Corporate Development |

Prairie Mining #PDZ – JSW coal eyes making decision on Prairie assets in July, could seek USD financing for further capex – PAP Biznes

Article by PAP Biznes

Listed coking coal miner JSW is in the midst of talks with coal miner Prairie Mining regarding potential investment in Prairie assets and might seek USD financing for capex projects related to Prairie assets if a positive decision is taken in July, CEO Daniel Ozon told PAP.

“Some talks with Prairie Mining have been conducted, further ones are scheduled for June,” Ozon said. “I would like us to make some decisions in July.”

“Those assets would generate for us 2-2.5 mln tons of coal annually,” he said.

JSW options include taking over Prairie Mining as a whole, or particular assets, because mining licenses belong to subsidiaries, not the firm itself. While all the assets are in play, the Lubelskie region projects are “remote, complicated.”

To finance the Prairie-related spending, JSW could seek financing on the US market, possibly a USD 500 mln benchmark bond issue, but first needs to complete the process of securing a debt rating.

“We could finance the transaction itself with cash, but further capex for example for a new shaft and the processing plant could be estimated at several billion zloty,” the CEO said.

“If we finish process with [rating] agencies … and the situation on the market is still good, then one can imagine that after H1 results we could go out with an issue of possibly benchmark size of some USD 500 mln,” he said.

Elsewhere in financing, JSW is in advanced talks with Polish banks on PLN 1 bln in refinancing.

‘We are quite advanced with closing deals with banks on refinancing,” the official said. “We are targeting neighborhood PLN 1 bln, we are talking here about a consortial loan.”

Net TG Pol – JSW arrangements for the reactivation of Dębieńska in a few weeks

“We are currently having one meeting with Prairie Mining, during which we started a dialogue on potential cooperation regarding the Dębieńsko mine” – said Daniel Ozon. As the president of Jastrzębska Spółka

“We are currently having one meeting with Prairie Mining, during which we started a dialogue on potential cooperation regarding the Dębieńsko mine” – said Daniel Ozon. As the president of Jastrzębska Spółka Węglowa added, the possible construction-restoration project of the mine has nothing to do with the planned increase in production from 15 to 18 million tons of coal.

Węglowa added, the possible construction-restoration project of the mine has nothing to do with the planned increase in production from 15 to 18 million tons of coal.

The meeting concerned the reactivation plans for the Dębieńsko mine in Czerwionka-Leszczyn, which carried out mining until 2000. Then, in 2006, the plant was bought by the Czech company NWR, which had plans to reactivate the mine. The Czechs were granted a mining license for 50 years, according to which they were supposed to start mining until the end of 2018. NWR Karbonia (a subsidiary established by NWR to reactivate Dębieńska) bought it from Prairie Mining Limited in October 2016. The Australians applied a year ago for a change to the mining concession (it is a change in the date of commencement of mining), and the yielding of coal is partly based on the still existing closed mine infrastructure.

The launch of the mine in Czerwionka-Leszczyny is also interested in JSW.

“We have so far, after one meeting with Prairie Mining, during which we started a dialogue on potential cooperation regarding the Dębieńsko mine, but it is still too early to talk about it. We heard what assets Prairie Mining has and we learned the potential cooperation options offered to us by the owner. For now, too early to talk about whether we could buy the right to the deposit or jointly implement the project. If we manage to conduct conversations in the right direction, we should pass on the particulars in a few weeks” – Daniel Ozon noted.

As JSW CEO said, the plans to reactivate the Dębieńsko mine have nothing to do with the planned increase in coal output from 15 to 18 million tons per year, which is mentioned in the company’s development strategy until 2030.

“It is organic growth, i.e. based on currently owned database of mines and resources, which does not provide for acquisitions. If we were able to implement the project to launch the Dębieńsko mine, it would theoretically involve a modification of our strategy” – added Ozon.

Link here to original article